Tesla Stock Forecast

Triston Martin

Jan 08, 2024

Tesla stock has been making waves, soaring to record heights and attracting a devoted following of investors. With its rise to prominence in the tech space, it makes sense that people would be watching closely for any new developments that could positively or negatively impact Tesla's performance.

Additionally, with so many changes happening worldwide, understanding where Tesla will go next can help investors make better portfolio decisions. In this blog post, we'll look in-depth at how experts predict Tesla's stock movement heading into 2023 and beyond based on the current market conditions.

How Tesla (TSLA) Performed in 2022

In 2022, Tesla performed relatively well. Its total revenue was $81.46 billion, up $27.64 billion from the previous year. Sales revenue increased by 52%, and revenue from automotive regulatory credits rose by 21%.

Despite this success, Tesla must still reach its 2022 delivery target numbers. It sold 1.3 million vehicles in the given year, a number lower than Musk's pledge of growing deliveries by 50%.

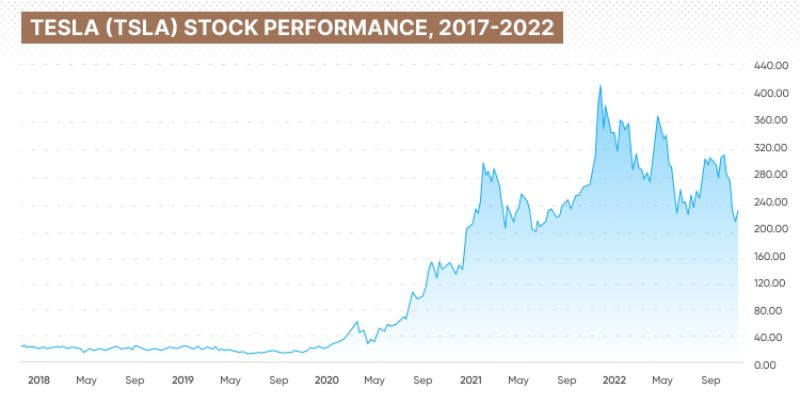

Tesla's stock had an impressive rise in 2021, resulting in TSLA reaching over $400 per share in October 2021. In 2022, however, it experienced a rocky performance and saw its stock price drop 69% by December 30th to close at $123.18 per share. The company did not pay dividends in 2022, as it has never done so, nor does it anticipate paying them shortly.

Although Tesla's delivery numbers were lower than expected and its stock price experienced a sharp decrease, the company still had a strong showing overall. It added new models to its lineup, such as the Model 3 and Model Y, which drove up sales revenue significantly. In addition, its regulatory credits increased by 21%.

The tech giant also made several advances in autonomy and self-driving capabilities over the last year. Tesla released Autopilot 8.0 during the fall season, allowing vehicles to navigate highways independently with radar sensors.

Despite some bumps along the way, Tesla ended 2022 on a strong note and continues to be a major player in the tech space. As more countries transition towards electric vehicles, we can expect further growth from the company in the coming years.

Tesla's Stock Performance Over the Past Five Years

Tesla's stock performance over the past five years has been remarkable. In June 2018, Tesla's stock was trading at $19.06 per share, less than a year before it reached an all-time high of $883.09 in August 2020. Since then, its share price has settled back to around $203 as of June 2021 — an increase of 962% from five years ago.

This impressive growth far surpasses the Nasdaq Composite index's 65% return over the same period, confirming that investment in Tesla is a sound decision for those looking to capitalize on long-term gains.

Furthermore, while there has been some volatility due to external factors and company news since 2020, many experts remain bullish on Tesla's prospects in the coming years.

Analysts have pointed to strong underlying fundamentals, including its unique product portfolio and autonomous driving technology, continually improving margins, and increasing demand for Tesla's vehicles.

In conclusion, despite some volatility in 2020 due to external factors, the past five years of performance suggest that investing in Tesla will likely be wise for those looking to generate long-term returns from their investments.

For this reason, many investors are closely monitoring developments related to Tesla as they make decisions about their portfolios for the future.

Challenges and Opportunities Facing Tesla

Challenges Facing Tesla

Tesla has achieved incredible success in the automotive and technology industries but has challenges. Here are some of the biggest issues that Tesla is currently facing:

Competition

As more auto manufacturers embrace electric vehicles, Tesla's competitive advantage erodes. Other companies, such as Lucid Motors (LCID), are producing vehicles that could significantly challenge Tesla's dominance in the market. Also, legacy car makers like Ford and Chevrolet are beginning to develop their electric cars.

Supply Chain and Labor Issues

For Tesla to meet its delivery targets, it must ramp up its manufacturing capabilities in both US and international facilities. This requires a reliable supply chain that can provide components on time and at the right price.

Additionally, Tesla relies heavily on labor inside the US and abroad, which could be affected by regional regulations or workforce shortages.

Opportunities for Tesla

Despite its challenges, Tesla still has many opportunities to expand its reach and consolidate its position in the electric vehicle market. Here are some of the biggest opportunities for Tesla:

Innovation

At the heart of Tesla's success is its commitment to innovation. The company continues to push technology forward with advances such as self-driving cars, battery advancements, and renewable energy solutions.

This focus on innovation sets them apart from other auto manufacturers and will remain a major asset.

Tax Incentives

The federal government offers tax credits for buyers of clean vehicles purchased in 2023 or after, providing up to $7,500 worth of savings. This significant incentive could attract new customers to Tesla's products.

Brand Recognition

Tesla has become a household name, even among those who don't typically follow the automotive industry. The company has successfully built an incredibly loyal following that continues to support its vehicles despite any challenges it may face.

This level of brand recognition gives Tesla a huge advantage over other companies vying for market share in the electric vehicle space.

By understanding the challenges and opportunities facing Tesla, investors can make better decisions about their portfolios. Although some major issues need to be addressed, the company's commitment to innovation and strong brand recognition gives it a great chance of success in the years to come.

With careful planning and execution, Tesla could continue to dominate the electric vehicle market for many years.

How Will TSLA Perform Over the Next Few Years

Tesla has seen incredible success over the past few years, and many investors have watched closely to see if it can keep up its impressive performance.

Analysts are generally bullish on Tesla's prospects in the coming years, with a Nasdaq analysis of recommendations from 30 analysts giving the company an average 12-month price target of $198.54.

Furthermore, some experts believe Tesla could enter a growth phase with new initiatives such as ridesharing and autonomous vehicles providing new revenue opportunities. With Elon Musk at the helm, Tesla will likely continue innovating and pushing into new markets, which could drive strong stock prices in the next few years.

While risks are associated with any stock investment, Tesla is well-positioned to continue its positive performance over the next few years. With a strong executive team and a focus on innovation, Tesla could remain an attractive option for investors looking for long-term returns.

In short, Tesla has all the pieces for continued success in the coming years, making it an attractive option for investors willing to take on some risk. By diversifying their portfolios with index funds or ETFs, investors can limit their exposure to any single company while taking advantage of Tesla's potential upside.

FAQs

Is Tesla a buy, sell or hold?

Tesla is a buy, according to most analysts. The stock has consistently outperformed the market over the past five years and is expected to continue its strong performance with new initiatives and innovative products in the coming years.

What are some of the risks associated with investing in Tesla?

Investing in any stock carries risk, and Tesla is no exception. Some of the key risks include changes in regulations, competition from other automakers, supply chain disruptions, labor issues, and volatile markets.

Does Tesla stock pay dividends?

No, Tesla does not currently pay dividends. The company has instead opted to reinvest its profits into research and development.

Conclusion

Tesla's stock performance over the past five years has been remarkable. With strong fundamentals underpinning its success, many experts believe that the company is well-positioned for continued success in the years to come. Investors interested in taking advantage of Tesla's potential upside should carefully research the stock and diversify their portfolios with index funds or ETFs to limit their exposure to any single company. By doing so, they can reap the rewards of investing in one of the world's most innovative companies while limiting risk.