Everything You Need to Know About Stop Loss Order

Triston Martin

Jan 04, 2024

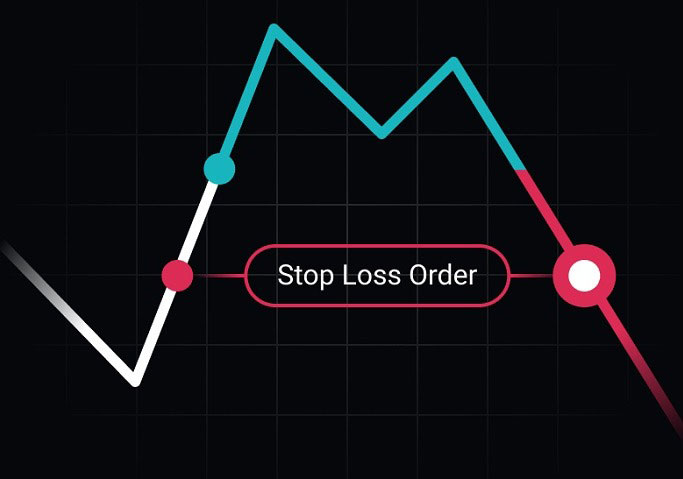

A stop-loss order is placed with a broker to buy or sell a specific stock once the stock hits a predetermined price. Investors use stop losses to restrict the amount of money they lose on a stock position. A stop-loss order of 10% below the price you purchased the stock will restrict your loss to 10%.

Now, let's say you just bought $20 worth of Microsoft (MSFT) stock. You immediately place a stop-loss order of $18 after purchasing the stock. Your stock will be sold at the current market price if it falls below $18.

As with stop-loss orders, there are stop-limit orders as well. However, as their name implies, there is a limit to the price they will carry out their services. If the limit price is met, the order will only be executed at that price (or better).

The Stop-Loss Order Has Many Advantages

Most importantly, the implementation of a stop-loss order is free. Once the stop-loss price is reached and the stock must be sold, you will be charged your regular commission.

Stop-loss orders can be thought of as a kind of no-risk insurance policy. On the other hand, stop-loss orders don't necessitate daily stock performance monitoring. When you're on vacation or otherwise unable to watch your investments, this feature comes in handy.

Stop-loss orders might also help you avoid making decisions based on your emotions. Many people fall in love with the stock market. The stock may turn around if they give it another chance or have other misguided notions. In reality, the delay may increase the amount of money lost.

Any investor should be able to quickly and readily determine why they own a particular stock. It's important to note that the criteria of a value investor will differ from those of a growth investor, which will differ from those of an active trader. Regardless of the strategy, it will work if you stick to it. As a result, stop-loss orders are nearly meaningless if you're a committed buy-and-hold investor.

Ultimately, if you want to be a great investor, you must have faith in your plan. This involves following through on what you've set out to do. By using stop-loss orders, you may avoid letting your emotions get in the way of good judgement.

For those who have a stop-loss order in place, it is vital to remember that it does not guarantee that you will profit from your investments in the stock market. If you don't, you'll suffer the same financial consequences as if you hadn't used a stop-loss (only at a much slower rate.)

Using a Stop-Loss Order Can Also Help You Preserve Your Gains

Traditionally, stop-loss orders have been viewed as a strategy to prevent losses. However, this technology can be used to secure earnings. At a percentage below the current market price, we've placed a stop-loss order to protect against further loss (not the price you bought it)—the stop-loss price changes in response to the stock's price movement.

It's vital to remember that you have gain; you don't have the money in your hands until you sell it. Allowing gains to run while still ensuring at least some realized capital gain is possible with a trailing stop.

Using the Microsoft example from earlier, let's say you set a trailing stop order at 10% below the current price, and the stock soars to $30 within a month. For example, if you had a trailing stop order of $27 per share, you would be locked in at that price.

If the stock's price falls, you won't lose money because this is the absolute lowest price you could get. The stop-loss order is still a market order, but it sits inactive until the trigger price is achieved when it is activated. As a result, the price at which your sell trades may fluctuate somewhat from the trigger price provided.

Drawbacks of Stop-Loss Orders

Small fluctuations in stock prices can activate stop-loss orders. This is one of the main disadvantages of stop-loss orders. Stop-loss percentages should be chosen such that an investment's price can fluctuate daily while still limiting the negative risk to a manageable level. Stocks that have historically fluctuated by 10% or more each week may not be the ideal candidates for placing 5 per cent stop-loss orders. If your stop-loss order is executed, you will most likely lose money on the commission.

The level at which stops should be set does not have any hard-and-fast rules; it is entirely dependent on the individual's investment style. There are two types of investors: those who are active traders and those who are long-term investors.

Keep in mind that after you hit your stop price, the order you placed becomes a market order. Your selling price may be significantly higher or lower than your stop price. This is especially true in a volatile market where shares can go up or down in minutes. 6 As an additional restriction, many brokers will not allow you to put a stop-loss order on specific assets like OTC Bulletin Board stocks or penny shares.

Stop-limit orders can pose additional dangers. These orders can ensure a price limit, but they cannot guarantee that the trade will be carried out. For investors, this might lead to losses in a quick market when the stop order is activated but no orders are completed before the limit price is exceeded.