Historically Significant Banks in Banking: A Chronology

Triston Martin

Oct 26, 2023

People have needed a safe location to keep their money since the first currencies were created. Also essential for ancient empires was an efficient financial system that could enable commerce, transfer riches and collect taxes. Banks were expected to play a significant part in this, just as they do now.

Banking Begin

Empires developed banking to pay for imported goods and services with a unit of account that could be readily swapped. Paper money was ultimately phased out in favour of more durable coinage. There were no steel safes in ancient households, so coins had to be kept safe. In ancient Rome, the wealthiest citizens kept their valuables in temple cellars.

The presence of priests or temple employees, who were thought to be dedicated and honest and armed guards, gave them a sense of protection. Greek, Roman and Egyptian records indicate that temples loaned money in addition to keeping it secure.

Roman Imperial Banking: A Brief History

Because of the Romans' prowess in construction and administration, banking was removed from the temples and institutionalized in separate buildings. In this era, loan sharks still made money, but the vast majority of legal business and government expenditure was done via an institutional bank.

According to the World History Encyclopedia, one of Julius Caesar's edicts modifying Roman law following his conquest allowed bankers to seize land as payment instead of debt repayment. Creditors and debtors were once again in the hands of the landed nobles, who, for the most part, were untouchable and passed debts down through generations until they died out.2 This was a dramatic shift in power in the relationship between the two parties.

European Monarchs Find Easy Cash

The kings who ruled Europe eventually realized the need for financial organizations. There were no formal charters or contracts for these banks, so they could only survive as long as the sovereign granted permission to operate.

This led to the monarchies borrowing from the king to cover shortfalls in the royal purse. With so much money available, monarchs could engage in extravagant spending, costly conflicts with neighbouring kingdoms, and weapons races that often led to crippling debt.

In 1557, Philip II of Spain created the world's first national bankruptcy and the world's second, third, and fourth, in fast succession—because of a series of useless wars. With 40 per cent of GNP going toward debt repayment, this resulted. 3 To this day, banks continue to ignore the creditworthiness of large consumers.

Adam Smith Creates Market Banking

When Adam Smith published his idea of the "invisible hand" in 1776, banking was already well-established in the British Empire. Moneylenders and bankers could restrict the state's participation in the banking industry and the economy because of his beliefs on self-regulation. 4 Free-market capitalism and competitive banking thrived in the New World, where the United States of America was about to be born.

Later, it was not until later that Smith's theories began to help the United States financial system. It took an American bank, on average, five years to go out of business, at which point most of the banknotes it created lost their value.

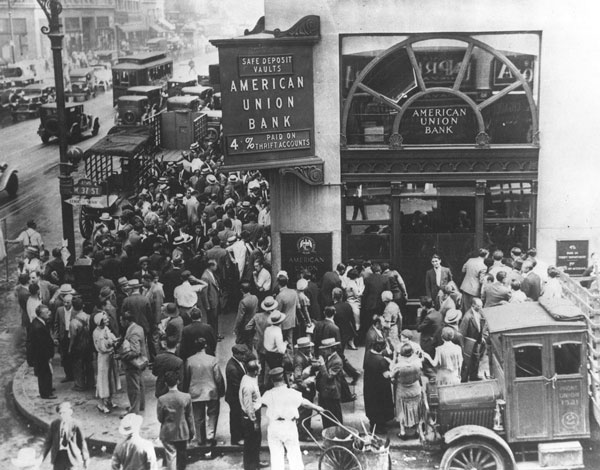

History's Most Powerful Banks

The foundation of our financial system is banking. The Crash of 1929 and the subprime mortgage and credit crises of 2008 serve as stark reminders. The economy suffers when banks don't operate correctly, and banking, like many other aspects of finance, has developed over time.

Mayer and Nathan Rothschild

German Jewish ghetto-dweller Mayer Amschel Rothschild was born into a Jewish family. Due to Christian anti-usury regulations, merchant banking was one of the few professions a Jewish person could readily enter in the 1700s. Mayer did just that, establishing a network of politically significant lords and princes by making low-interest loans. To build a fortune, he utilized his contacts to teach his sons the art of banking before sending them to study overseas.

Junius and J.P. Morgan

This father and son pair brought true finance to the United States. George Peabody benefited greatly from Junius Morgan's assistance in strengthening American linkages to the English finance markets. America's state bonds were bought mostly by English-speaking investors.

His son, J.P. Morgan, succeeded him, who took over the farm after his father's credit ensured rapid industrialization. J.P. was in charge of the financial restructuring of businesses, reducing the number of conflicting interests to a small number of enormous trusts.

J.P. Morgan rose to the top of Wall Street because of this concentration of power in the 20th century. Before the founding of the Federal Reserve Bank, Morgan and his syndicates were the central banking system of the United States of America.

Paul Warburg

During the Bank Panic of 1907, J.P. Morgan's involvement underlined the need for a more robust financial system in the United States. Paul Warburg, a banker of Kuhn, Loeb & Co., was instrumental in establishing the United States' first modern central bank.

Warburg immigrated to the United States from Germany, a country well-versed in the idea of centralized banking. The design of the Federal Reserve was greatly inspired and supported by his publications and participation in committees.

Unfortunately, one of his most crucial concerns, the political neutrality of the Fed, was weakened when the president was granted sole power to select Fed leaders. However, Warburg refused to take a position higher than vice-chair of the Fed until he passed away.