Everything You Need to Know About Redlining

Susan Kelly

Jan 31, 2024

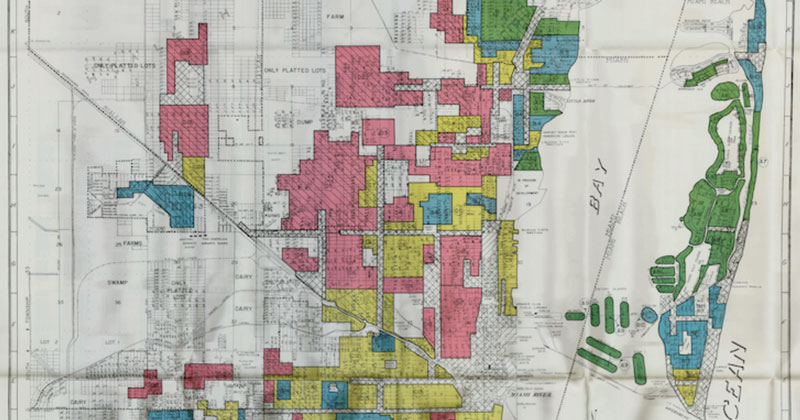

Redlining is a form of discrimination that excludes people of specific races or ethnicities from obtaining essential services (financial and otherwise). Mortgages, insurance policies, and other banking are denied based on geography rather than an individual's credentials and creditworthiness. This can be demonstrated in the systematic suspension of these services. Additionally, inhabitants of minority communities bear the brunt of redlining policy.

Getting a Handle on Redlining

A sociology professor named John McKnight popularized the term "redlining" in the 1960s to describe how lenders and the federal government would draw a red line around districts they refused to invest in solely because of their demographics. Redlining was more common in black inner-city areas.

Who showed lenders to be more interested in lending to lower-income Whites than to middle or top half African Americans? Exorbitantly expensive housing contracts drove many Black citizens who wished to own homes into contracts that inflated the housing price and left them with no equity before making their final payment.

A group of citizens from Chicago's inner-city founded the Contract Buyers League in the 1960s to resist these abuses. Real estate was really "redlined" by the federal government in the 1930s, designating "risky" areas for public mortgage loans based on racial characteristics. Redlining in the housing market had a long-term impact on the economy.

At the beginning of the 1990s, the value of homes in redlined communities was less than half of those in neighborhoods considered the greatest for residential mortgages. This difference has only become worse since then. "Redlining" has become a catchall term for a variety of historically race-based exclusivist tactics in real estate, from real estate agents' racial steering (directing Black home buyers and renters to specific neighborhoods or high rises and away from everyone else) to racial covenants in numerous suburbs and developments in the last few years. There are several reasons why today's America looks the way it does.

Particulars to Keep In Mind

When issuing loans, lending institutions may consider economic variables, even if it is against the law to redline areas based on race. Some borrowers may face higher interest rates or harsher repayment terms if they apply for a loan from a lending organization. However, these considerations can't be made based on race or religion or national origin or gender, or marital status under U.S. law.

Lenders without regard to the applicant’s race, gender, ethnic origin, sex, or relationship status must evaluate each of the factors above. It's possible for homeowners and mortgage applicants who believe they've been discriminated against to contact a fair housing center or a fair housing and egalitarian office at the United States Ministry of Property and Urban Development.

What Is The Meaning of "Redlining"?

A sociology professor named John McKnight popularized the term "redlining" in the 1970s to describe how lenders and the federal government would draw a red line around districts they refused to invest in solely because of their demographics. During the 1930s, the government began to apply racial redlining to real estate, designating certain areas as "risky" for receiving federal mortgage loans.

Redlining Is a Form of Racial Profiling

Redlining is a kind of discrimination since it restricts access to services (financial or otherwise) for people based on their ethnicity or race. This trend can be observed rather than considering an individual's qualifications and creditworthiness when denying financial services like mortgages, insurance, and loans. Redlining was more common in black inner-city areas.

Who showed lenders to be more interested in lending to lower-income Whites than to middle or top African Americans. Redlining in the housing market had a long-term impact on the economy.

To Get a Loan, What are some of the Things Banks Can Consider?

Banks and other financial institutions can consider economic variables when granting loans. Lenders are not compelled to approve all home loans under the same circumstances or may impose higher interest rates or stricter repayment terms on specific borrowers if these choices are made entirely on economic grounds. Laws in the United States prohibit the use of these factors in making choices about whether or not an applicant is approved.

Trade and Invest Your Way to Financial Freedom

Discover something about buying and selling stocks with these helpful resources. There are many courses to choose from, no matter how you choose to learn. With Udemy, you'll be able to select classes taught by true professionals and learn at your speed, with lifelong access on desktop and mobile. Day trading, contract spreads, and other concepts will all be covered. Explore Udemy and get began right away!