How Does Mint.com Help to Makes Money?

Susan Kelly

Jan 03, 2024

Mint promises to give you tailored financial information by bringing together a perspective of your whole financial life, including bank accounts, invoices, Mint Money, and investments, to assist you in managing your Money. Since its inception in 2006, it has had tremendous success in raising finance and developing its client base, including millions of customers. Following its purchase by Intuit (INTU) in 2009, the company's processes improved, enabling it to capitalize on a broader range of revenue opportunities. A similar procedure is followed in the case of investments, credit cards, and other types of financial holdings. Users may enter information about the real estate properties they possess to keep track of the value of their assets to make money.

Mint was created in 2006 with funding from angel investors totaling $750,000. A similar procedure is followed in the case of investments, credit cards, and other types of financial holdings. Users may enter information about the real estate properties they possess to keep track of the value of their assets. During its Series a venture capital fundraising round in 2007, it got $4.7 million, and it received $12 million in its Series B round the following year. Mint got $14 million from six investors in August 2009. Mint was acquired by Intuit for $170 million only a few months after it was founded.

Mint's Advertising and Promotional Services

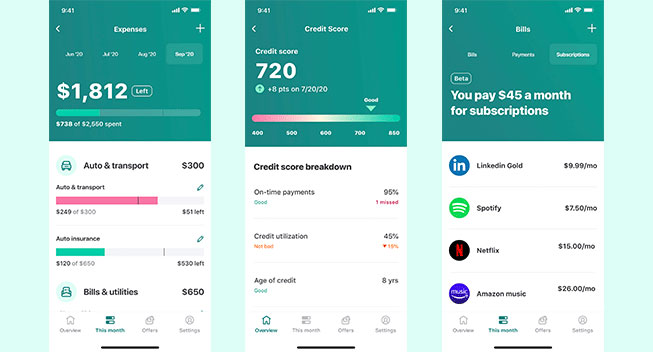

Mint has monetized its free product by adding adverts on different portions of its website and mobile application to earn advertising money from the product. Companies may acquire advertising space on Mint's numerous platforms for a small charge. Mint uses targeted advertising, which means that consumers may find the adverts relevant since past search history and parts of the user's profile are taken into consideration when the contextual ad displays are shown.

Mint's Referral Business

Mint earns Money by referring users to financial institutions, goods, and credit cards, which results in commissions. Through its "Ways to Save" service, Mint provides financing options that may interest users in the future. When a customer takes advantage of Mint's recommendations, the suggested firm pays Mint a referral fee to show appreciation. For example, Mint often suggests credit cards based on their annual percentage rate (APR) and reward point offers. The company's income is generated when a person signs up for a credit card via Mint.

It is necessary to use the referral service whenever a user asks for changes or alternatives. For example, a person may choose to look at different credit card alternatives and see how they compare their existing financial situation. Alternatively, a person may look into other banking options to get greater interest rates and fewer banking expenses. Mint offers customers referral links that lead to information on these services, which they may click on. When a consumer clicks on the referral link and completes an offer, the link generates Money for the affiliate.

The Most Serious Obstacles

Like many other businesses, Mint has experienced a variety of difficulties in terms of competitiveness and development during its existence. As indicated by the firm's fundraising history in its early years, the corporation had a very successful first few years. Even though Mint now has great brand recognition and a large user base, there are constantly new services vying for consumers' attention. For example, when competitor personal finance service Mint revealed intentions to discontinue its bill pay service, rival personal finance firm Prism refocused its marketing to show that it was still providing this service to subscribers.

The Business Model of Mint

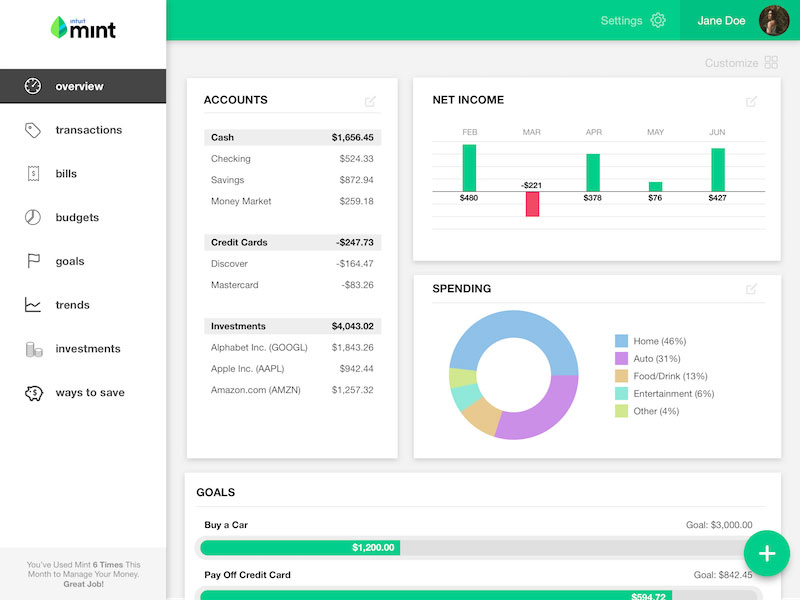

For Mint to function, all parts of an individual's finances must be collected in one spot. A user's Mint account is linked to their bank account via a link. Then, when transactions take place, Mint gets the financial information and generates reports that may be customized. A similar procedure is followed in the case of investments, credit cards, and other types of financial holdings. Users may enter information about the real estate properties they possess to keep track of the value of their assets.

Mint provides consumers with a simple method to see all of their bills and Money in one convenient location. This enables a person to build and maintain a budget while also offering a mechanism for users to get notifications for various sorts of activity on their accounts. Please use our FREE Stock Simulator to put your trading talents to the test. Compete against thousands of others; you'll have the experience you'll need to succeed.