Best Home Equity Loan Rates in 2022

Triston Martin

Oct 26, 2023

Home equity loans let people who own homes get money from the value of their homes. Equity is the difference between your home's worth and how much you owe on your loan. They are popular with people who want to use the money for home improvements or pay off high-interest debt. There are still a lot of problems with home equity loan rates. Here are some things you should know about them:

How does Home Equity Loan work?

A home equity loan is a one-time payment that you borrow against the value of your home. If you have a lot of equity in your home, most lenders will let you borrow up to 80% to 85% of that equity. These loans have interest rates that stay the same, and repayment terms range from five to 30 years. As long as you pay your home equity loan, the lender can take it if you don't.

At several banks, credit unions, and lending institutions, you can get a home equity loan to help you pay for things like college. You can use these funds for various things, like paying off debt, making home improvements, or paying for college. The amount of equity you own in your home, as well as your financial position and many other considerations, determine how much you can borrow.

Best Applications for a Home Equity Loan

When it comes to home equity loans, they can be utilized for anything and everything. However, getting out a mortgage for anything that you can expect to be paid for in another direction or that you don't have can be very costly in the long run. That's why financial professionals say that you should be extremely cautious with what you spend loan money on. Some of the best ways to use your loan are:

- Home improvements: It can be good to use your home's worth to make improvements that can make it more valuable over time.

- Education: Home equity loans are usually cheaper than student loans because they have less money to pay back.

- Debt centralization: Utilizing your home equity to consolidate debts may result in lower interest rates, allowing you to receive your finances back on track.

- Emergency expenses: Sometimes, when you don't own the funds to cover an urgent expense right away, a home equity loan can provide you with funds at a much lower interest rate than that of a personal loan.

- Investments: Even though they can be risky, borrowing money from your home can help you build up your financial profile over the moment.

Find Out How to Get the Best Rate on a Home Equity Loan

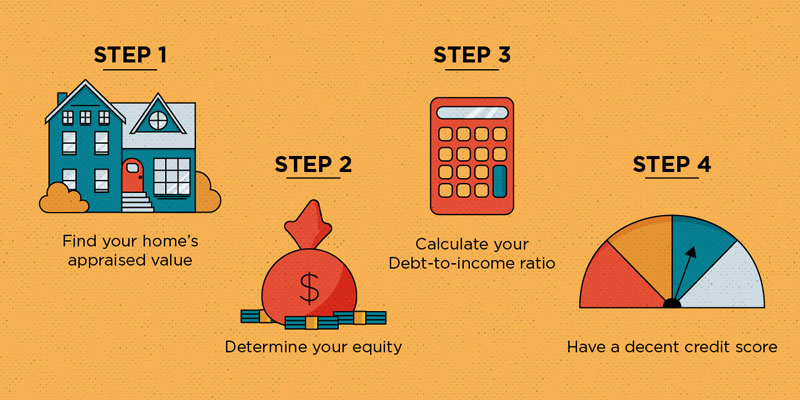

When looking for a home equity loan, you must always try to get the best rate you can. Cost-cutting measures will be taken to reduce your expenses. Some ways to find the best prices:

- Interest rates could fluctuate, whether because of changes in the economy or because banking firms alter the special deals they offer. Please make a point of keeping an eye on interest rate trends and how they fluctuate with time.

- Enhance your credit score once you apply: People with good credit are more likely to get loans with lower interest rates. Your credit rating will go up if you pay off debt, pay your payments on time, correct errors on your credit file, and don't open several new kinds of loans before obtaining a home equity loan.

- Shop around: There can be a lot of differences in rates between lenders. Compare rates from different lenders to find the best deal for you. Try to get at least three quotes from different lenders, but look for ones that don't put a hard inquiry on your report. Too many tough queries could damage your credit score, so you should be careful.

Conclusion

There are many ways to develop equity in your home. When your property increases in value because you make a big down payment, and you pay down your debt, you will have more money in your home. The distinction between the home's value as well as what you possess on it is called home equity. Banks have different costs, loan terms, and eligibility demands that you should think about. Most banks and lenders don't let you borrow 100% of the value of your home. Mortgages and home equity loans are two types of loans that you can get against your home. Typically, these loans can't be more than 80% to 90% of the value of your home.