Everything You Need To Know About Personal Capital

Triston Martin

Jan 11, 2024

Personal Capital, established in 2009, is one of the earliest digital asset managers and our top-rated Robo-advisor for asset management. Empower Retirement acquired the company in 2020, and the company differentiates itself by providing a full variety of free money management solutions for investment management. Personal Capital Cash provides every citizen of the United States with accessibility to a high-interest rate savings account and a variety of free banking services. Continue reading to know about personal capital review.

Fees

According to the Federal Reserve, people who enroll in wealth management services and invest less than $1 million per year pay yearly .89 percent of their invested assets. This is a one-time, recurring yearly expense. The amount of money that investors pay decreases as their investment grows. Those that spend $2 to $3 million, for example, pay .79 percent of their money back—those who make investments over $10 million pay .49 percent. In addition to asset management, trading commissions and custody are included in this yearly charge. Although Personal Capital does not provide wealth management services, you may use the site to compile your net worth for free.

Working

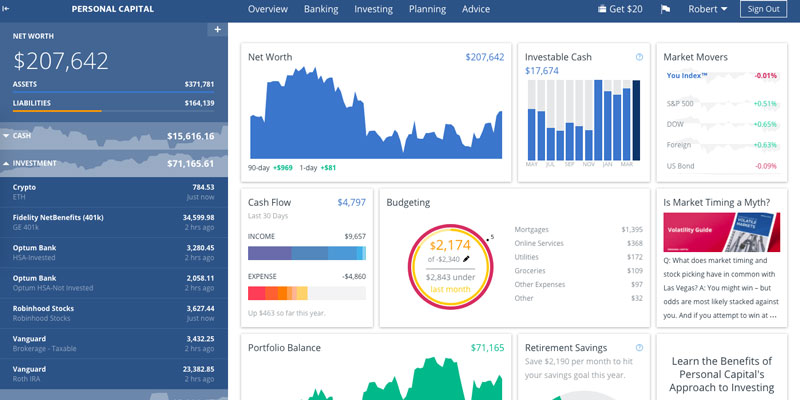

Your net worth will be calculated when you've linked all of your bank accounts with one another. Users may start tracking their investments, budgeting, and retirement planning right from the dashboard. The first consultation with a financial adviser is free to users who connect $100,000 or more in investable assets. A series of intake questions are asked by advisors, after which they give consumers a customized approach. Participants in wealth management services will open accounts with Pershing, a third-party custodian that uses cash transfer securities to hold their assets. From then, wealth management specialists monitor and balance your portfolio, searching for ways to minimize expenditure and lower tax costs as well as increase your net worth.

A Plan for Achieving Your Objectives

Personal Capital Advisors' goal planning process is unique in that it goes beyond just checking boxes for retirement, college preparation, or vacation planning. Your financial adviser will guide you through the goal-setting process, which starts with a chat once you have completed the quick questionnaire. Most investors have retirement as a goal, although any objective may be considered, such as saving for college tuition or funds for a second house.

Clients must also pay the expenses of the exchange-traded funds featured in the portfolio, additional to the management charge, as is the case with most financial advisers in the industry. Personal Capital's costs are quite minimal, averaging approximately 0.08 percent on a monthly basis.

Beneficial Tools

Among the various tools available on Personal Capital are those for analyzing your portfolio, determining how much you could need in the future to cover a certain cost, calculating your net worth, and many more. Because you can use many of the tools even if you don't become a customer, it's an excellent resource for anybody to check out; however, Personal Capital also includes other features only available to clients.

There are various tools accessible, including a net worth calculator that draws data from your connected bank accounts, along with a savings planner and a budgeting tool. You'll also have access to tools for retirement planning, school spending, and estimating the fees associated with your mutual fund investments. Clients will get several additional benefits, such as a financial roadmap and personal planning tools. You'll also be able to compare your employer-sponsored plan, such as a 401(k), to your personal approach designed by the Robo-advisor to determine how well it corresponds with your overall financial goals.

Advantages

Personal Capital provides an easy-to-navigate collection of tools and resources—many of which can be used by anybody, even non-clients, to acquire a 360-degree perspective of all of their financial assets and liabilities. Personal Capital's retirement tools, which enable you to connect your accounts for free, provide you with a sense of your retirement preparation based on what you may anticipate from Social Security, based on when you file, and how actively you are investing your savings and retirement funds.

In addition, the investing platform is smart and supported by a team of industry veterans. It claims to leverage its expertise to generate greater returns than you can get from a basic index fund while also lowering your tax burden. To alleviate any uncertainty, you may consult with a specialized financial advisor to learn how your capital is being invested, how well you are doing toward your objectives, and what to do if your life situation changes.