Everything You Need To Know About Kohls Credit Card

Triston Martin

Dec 09, 2023

The Kohl's Charge credit card, a co-branded product of the retailer and Capital One, might be a good option for regular shoppers wishing to save some money on purchases. However, getting the most value out of the card might be difficult since you'll have to keep track of several deals, promotions, and discounts to get the most out of the card. Continue reading, and find kohls credit card review.

Additional Information on the Card

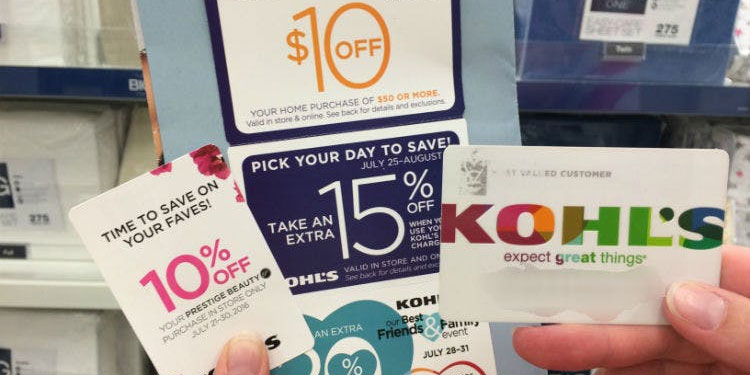

You will not get many perks as a Kohls Credit Card customer since the Kohl's Credit Card is a fairly basic shop credit card. The best part about having this card is the coupon savings you'll get throughout a year, which may save you up to 30% off your purchases. The 15 percent discount coupons that members who do not have the card normally get might be increased by up to double. Your online account, as well as discounts you'll get in a mail and through email, will allow you to take advantage of these savings. Every calendar year in which you spend a minimum of $600 on your Kohl's Card, you'll be eligible for Most Valuable Customer status with the retail giant. In addition to receiving additional discounts throughout a year, this distinction also entitles you to get more free shipping options.

You may almost certainly find a Kohl's in your area since the chain has roughly 1,200 locations in 49 states. In the world of frugal shoppers, Kohl's has a cult-like following, and those customers are precisely the ones who would profit most from the Kohl's card. Regular shoppers at Kohl's will appreciate the benefits of the card, which include no annual fee, monthly coupons, birthday presents, and invitations to special deals.

The best way to get the most out of this retail card is to stack many savings opportunities on top of one other, requiring cardholders to be smarter in using their card. The higher the APR, the more difficult it will be for bargain hunters to pay off their amount, so those who like to buy on the spur of the moment should keep a tight check on their spending.

It's no surprise that the Kohl's Card has a low overall appeal due to its high variable APR of 24.99 percent. To add light to injury, rewards certificates have a 30-day expiration date. This means that you may end up charging more than you can afford to pay off each month, or your rewards may expire before you get a chance to redeem them if you don't keep records of your balance and rewards.

Using

Shoppers have developed a strong loyalty to Kohl's due to the company's discount and shopper rewards programs, which, when combined, may result in significant discounts for customers. The offer of 35 percent off the initial purchase, besides all other discounts, makes getting new Kohl's credit card an appealing option for many people who shop at the retailer. When it comes to developing credit, a retail store card such as the Kohl's Card may be an excellent alternative for those new to the processor attempting to restore a positive credit history. The qualification for retail store cards is often less stringent than standard credit cards.

Negatives

Because this is a store card, it may only be used for purchases at Kohl's; it cannot be used in the same way as a Visa or Mastercard. Kohl's Credit Card has a high-interest rate, which is rather common for store card compared to generic reward cards, and Kohl's Credit Card is not exempt from this rule. If possible, avoid carrying the debt since the financing costs will soon negate the value of whatever savings you have received.

The Customer's Perspective

Calling customer support will get you through to a representative. The retailer also provides a mobile app which allows you to keep tabs on all of your rewards or makes payments using a mobile payments option, Kohl's Pay, that is only available to Kohl's credit and debit cards.

Kohl's does not emphasize any particular security measures on its credit card. The Kohl's Credit Card features fairly conventional shop card costs, including a high annual percentage rate. If you shop at Kohl's on a regular basis, the Kohl's Credit Card may provide substantial savings at no additional cost to you. However, bear in mind that, as a store card, it is only valid at Kohl's, which makes it rather limited in terms of frequent usage.