What is the Price Earnings ratio?

Susan Kelly

Jan 28, 2024

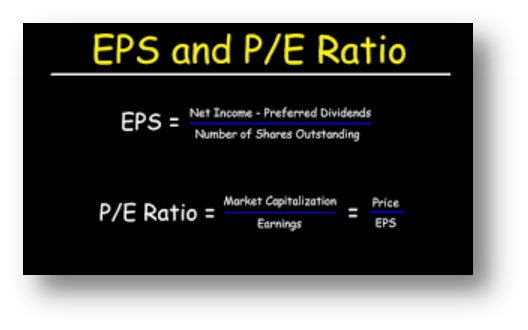

The price-to-earnings (P/E) ratio is used to value a company by comparing its current valuation to its earnings per share (EPS). The price-to-earnings ratio (P/E) refers to both the price multiple and the earnings multiple. Analysts and investors use P/E ratios to assess the value of a company's shares when making apples-to-apples comparisons. When comparing firms and the whole market, this measure may be used to do so.

What do you need to know about P/E Ratio?

Investors and analysts use the price-to-earnings ratio (P/E ratio) to compare the stock value of two companies. The price-to-earnings ratio (P/E ratio) can be used to determine the worth of a firm. When evaluating its P/E ratio, compare it to a market benchmark such as the S&P 500.

These pay ratios represent the average of salaries over the previous 10 or 30 yrs. These longer-term measures may be used to account for changes in the economy's business cycle when evaluating a stock index such as the S&P 500.

The price-to-earnings ratios fluctuated between 5x in 1917 to more than 120x lately. With a long-term price-to-earnings ratio of around 16x, derivatives pay a premium to their weighted average salary.

Forward Price to Earnings

A P/E ratio might be forward or backward. 2 actual quarters with two future quarter estimates is unusual.

Alternatively, you might use forward P/E. Indicator of future earnings that enables comparing present profits to future earnings without accounting changes.

Firms underestimating profits to surpass projected P/E is a flaw in the forward P/E indicator. Also, overestimate and then correct.

Trailing Price to Earnings

Trailing P/E is calculated using past year EPS. For obvious reasons, it's the most often utilized. For this reason, some investors favor the trailing P/E ratio. This is because past performance does not necessarily predict future conduct.

Investors should focus on future earnings potential rather than past success—issues with stable EPS when stock prices move. Due to major business events, the trailing P/E will be less sensitive to stock price changes.

Unlike the trailing P/E ratio, quarterly profits change with the stock price. So some investors prefer P/E. Inflation-adjusted P/E ratios should be lower than trailing P/E ratios.

Absolute vs. Relative P/E ratio

In their research, analysts might differentiate between absolute and relative P/E ratios.

· Absolute P/E ratio

The numerator of a P/E ratio is typically the current stock price. The denominator generally is trailing earnings per share (TTM), predicted earnings per share for the next 12 months (forward P/E ratio), or a mix of these two figures.

Remember that the absolute P/E represents the P/E for the current period. For example, if a firm is valued at $100 today and its TTM profits are $2, the price-to-earnings ratio equals 50.

· Relative P/E ratio

P/E ratios are measured in their absolute value with an industry benchmark or even a range of historical P/E values more than a relevant period, like the previous ten years. Relative P/E depicts how the present P/proportion E's compare to the preceding P/proportion E's. It compares the actual P/E to the greatest value in the range, although it may alternatively be compared to the historically low value in the range.

If the current P/E is less than the prior number, the current P/E is said to be connected to the preceding number. In this case, it is the preceding high or low. If the current P/E exceeds the former P/E by 100 percent or more, the current P/E has exceeded the prior P/E.

Use of P/E Ratio Has Drawbacks

It, like all other factors used to help investors decide if a company is worth purchasing, has substantial limitations.

Price-to-earning ratio estimations might be difficult for companies that aren't profitable. What to do? Some claim a negative P/E, while others claim none.

Firms' valuations and growth rates may vary dramatically among sectors and even within the same industry, owing to the different revenue-generating strategies.

P/E should only be used to compare similar firms. Comparing their P/E ratios leads to the conclusion that one is superior.

Which Price to Earnings Ratio is Ideal?

Depending on the industry, what is a reasonable price-to-earnings ratio? The average P/E ratio of certain sectors will be higher than that of others. Among publicly traded broadcasting businesses in January 2021, a trailing P/E ratio around 12 were usual, but over 60 for software companies. You can determine whether a company's P/E ratio is high or low by comparing it to the industry average.

P/E Ratios: Is It Better to Have a High or Low Value?

The lower the P/E ratio, the better, according to many investors, since you're paying less for each dollar of profit. Investors looking for bargains will find a lower P/E ratio attractive. Understanding a company's P/E ratio is critical in the real world. For instance, a low P/E may be an illusion if the firm's basic business model is in decline.