What is annuity buyout?

Susan Kelly

Oct 15, 2023

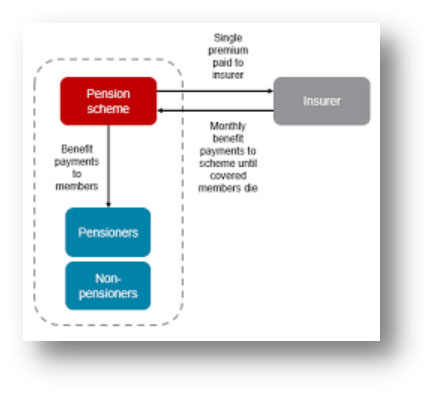

With a buyout, trustees give general legal duty for administration, payments, and communications to an insurer. While all members are covered, trustees may buy out a subset of members, in which case all members must be treated equally. Modify program rules or cover all benefits to ease annuity buyout.Creating a buy-in policy for any users or members not previously covered is the first step in buying out. Subsequently, individual annuity insurance is issued to the insured, who becomes a policyholder. The insurance commits to pay each selected member's total pension. If all members are insured, the trustees may close the plan.

Purpose of Annuity Buyout

- The trustee and sponsoring company are no longer responsible for fulfilling the benefits of the pension plan participants if we buy them out.

- After a buyouthas been completed and individual policies have been given to members, a pension plan will usually be wound down.

How does Annuity Buyout work?

- In exchange for buyoutinsurance, the trustees pay a premium to us. Our agreement with the insurance stipulates that we'll deliver the stated benefits as well as any death benefits, like dependents' pensions, to the insured members until they pass away.

- Regulations compel us to have 'capital reserves,' or extra monies, on hand to cover our insurance policies. These reserves should be sufficient to cover all of our obligations in a catastrophic event.

- The system will be wound down for more than a period, which may range from 6 months, at which point individual members will get their insurance.

- The trustees and the employer are no longer liable to the policyholders after the individual annuity buyoutplans have been issued.

Responsibility of Insurer

Notifying all retirees and postponed pensioners in the example mailing Direct payment of future pensions to these persons and their dependents Members should anticipate other alerts, such as annual P60s. Any increase in pensionpayments must be calculated and paid. Answering members' questions, Bereavement, and dependent compensation should be controlled.

The benefits of Annuity Buyout

- Policyholders are legally liable to the insurer. The trustees may discontinue the scheme if all members (pensioners, delayed pensioners, and dependents) are covered.

- If all members are covered, the sponsoring company is not required to contribute. Their final buy-in policy payment may be their last program contribution.

- The annuity buyoutclears the scheme off their books. Because bulk annuities are insurance products, members insured have the same protections as a buy-in: The PRA regulates insurers and protects against bankruptcy.

- The Financial Services Compensation Scheme protects policyholders if an insurer falls bankrupt and cannot pay its obligations under buyoutpolicies.

- This will pay the entire pensionowed to each covered pensioner and delayed pensioner under the policy, without limit or restriction.

- The insurer's bankruptcy will be paid entirely for all scheme participants covered by the bulk annuity.

Before agreeing to a lump sum buyout, here are five things to consider

Because managing pensionsis costly and time-consuming, more businesses provide lump-sum pension buyouts. Employers grant buyoutsas a lump amount to eliminate continuing obligations to employees. Some employees may benefit financially from a lump-sum buyout, while others may not. But it may be a win-win situation for all parties, including the employees who earn a high income.

Health and lifestyle:It is based on actuarial data on life expectancies. Consider the duration of monthly payments and the lifespan. So, if you lead a healthy life, you may outlast the typical person. Choosing monthly payments over a lump sum payment makes sense. A lump-sum buyoutmay be appropriate if you record a short life expectancy.

Income, Expense, and Habit:It's vital to wisely plan for retirement and budget. Calculate your monthly expenses to determine your necessary income. Retirement savings and other income streams must be evaluated. While most retirees take 4% of their portfolio annually, this may not be the case for everyone. Also, if you're cheap, bypassing a buyout may be better.

Risk Bareness:A lump-sum payout with active investing for 20 years may outperform a monthly pensionplan for those in their fifties. You take on the investment risk when you buy out, not your boss. If you accept the lump sum, you may invest in yourself and perhaps make more. Assess your risk tolerance.

Employer's long-term prospects:Employees occasionally overlook the company's future. But not all firms are financially sound. Employees may get just a portion of promised pension payments if a company collapses and its pension obligations are guaranteed. Consider the company's long-term prospects when deciding on a lump sum.

Future Goal:It depends on your retirement plans.Enrolling in a pension plan is your best bet. Leaving a legacy to children or grandkids may be preferable with a lump sum. A lump-sum buyout vs. pensionpayment depends on your entire financial situation and retirement goals.