How does credit card processing works?

Susan Kelly

Jan 04, 2024

In the span of milliseconds, several activities occur behind the scenes each time a customer swipes a credit card. Each of these steps is part of the transaction, which starts the moment the cardholder inserts or swipes their credit cardinto the credit card reader. An "approved" or "declined" status indicates that the transactions have been appropriately handled.

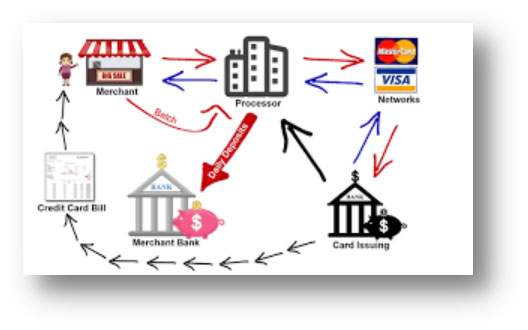

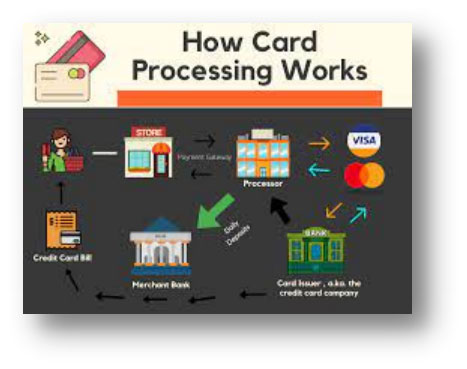

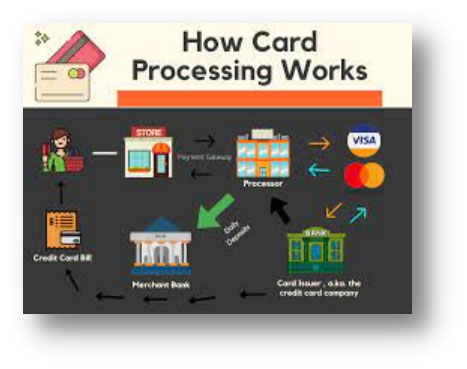

There are some parties involved: When it comes to credit card processing.

- Account holder:If the cardholder is making an online purchase, they may either swipe or input their bank account number into such an online payment gateway.

- Marchant:A merchant is a person or business that sells products and services. Customers swipe their cards on a company-provided machine, and the bank or card firm receives the processing fees.

- Merchant Bank: The merchant bank (Acquiring) delivers the card and transactional data to the card network. The acquiring bank may provide a merchant account and credit card processequipment.

- Card Network:There are three parties engaged in every transaction: the cards network (e.g., Visa or MasterCard) acts as an intermediary between merchants and issuers of credit cards.

- Issuing Bank:The issuing bank is the financial institution that provides the cardholder with a credit card. The acquiring bank gets compensated, and the cardholders are billed every month for each transaction.

Authorization of Credit card processing

To begin processing credit cards, the issuing bank must provide its approval. When a cardholder whacks a card, the notification appears. Cardholders get a license or refusal in milliseconds.

- Credit cardsare swiped, tapped, or inserted into a merchant card machine by customers. Enters a payment card number (or, if buying online, a password)

- The acquiring bank's (or merchant bank's) responsibility is to receive and process the cardholder data and transaction details from the merchant's credit cardterminal.

- The received information is sent to card networks by the bank.

- The card network transmits the information to the cardholder's issuing bank.

- Credit and commerce international banks examine card info and CVV codes to guarantee that a payment is not illegal. The bank will pay the purchase if the cardholder is a good client and has adequate credit left over.

- Acquiring bank receives feedback from the issuer through the card networks.

- The merchant'scredit card device receives the answer.

- The required information is given; the transaction will be completed. Otherwise, a notice such as "denied" will appear on the screen. The answer code is kept on the trader's system for card processing stage two, whereas cardholders see this information immediately and satisfy the transaction.

- Online and in-store purchases may vary somewhat. Businesses may sign up for Square, for example. It was customary for firms to set up an acquiring bank account. As a result, merchants are no longer directly contacting an acquiring bank but with a third party.

Settlement of Credit card processing

The merchant, the card networks, and the bank have all agreed. This entails the transfer of monies between organizations (including processing fees charged to the merchant).

The POS system saves each credit card authorization. A merchant delivers a batch of approvals to the acquirer late at night. It then goes through each assignment and provides the group with the right bank. The merchant will be credited by the purchasing bank (minus any credit card processfees).

The Credit cardnetwork reimburses the issuer. The card network acts as a middleman for each transaction, debiting the issuing bank and crediting the acquiring bank.

Any recent transaction that was previously “pending” may now be “posted” for the cardholder to view. Third-party purchases usually take 1–3 business days to settle. They pay the cardholder's purchase amount plus any fees or interest due.

Learn about credit card processing

to better understand what may go wrong. We need to know about credit cardprocessing for several reasons. Which are given below:

Businesses pay a small fee to accept credit cards from banks and networks. Customers who pay by credit card may be charged a minimum. Merchantsmay mark up pricing to offset credit card processfees.

Retailers may promote "cash only" to keep prices as low as possible. For this reason, many firms choose not to charge credit card processing fees since they are forbidden in many areas. When a shop does not want to deal with the expenses of accepting credit cards, they will put "cash only" on the register.

Credit cardfirms, issuers, and customers all gain from rewards programs, but retailers suffer as a result. Some price increases are due to the expenses of payment processing. Because some restaurants do not take cash or checks, people who do not qualify for money back or other perks must pay higher interest rates.