Convertible bond premium

Susan Kelly

Jan 26, 2024

Common shares exchanged for convertible bonds are known as "conversion values" or "stock values," respectively. A Convertiblebond with no conversion feature has its market value determined by its bond value, often known as the floor price. Bondholders who hold convertible bonds will pay a premium in addition to the increasing value of the convertible bonds. To determine the premium, a methodology is created and tested. You can calculate this by subtracting its bond or conversion price from the convertible's current market value and multiplying it by that figure. Without convertible preferred, the premium estimate will be ignored.

"Conversion premium" refers to the difference between the current market value of a convertible bond and the common stock's value into which it could be converted. When a bond's value is greater than its conversion or straight bond value, a "conversion premium" is incurred."

When a firm issues convertible bonds, it is a debt instrument that can be exchanged for the company's common stock. Once the bond is issued, the price at which the bondholders can convert the bond into stock, or the conversion price, is established. Any time before maturity, convertible bonds.

Issue a convertible bond with a predetermined par value, maturity date, and coupon rate, just like you would with a conventional non-convertible bond.

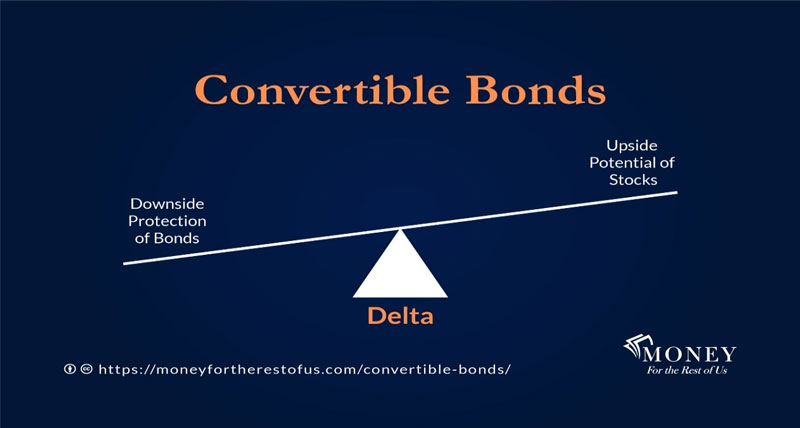

Investors find convertibles attractive because they mix the security of a debt instrument with the opportunity for stock-related gains. If the company's stock price falls, the holders of convertible bonds will be unaffected. If the stock price of the company goes up, the investor stands to gain from their decision to convert. If you are trying to make a high return on your investment, then a convertible bond may not be for you. A big reason for this is the possible benefits of the conversion feature. The issuer of a convertible bond has the power to force an investor to exchange their bonds for a defined no. of shares of stock at a specified price, which is called "call."

Understanding a Conversion Premium:

Understanding conversion premium: Securities that can be converted into a specified number of common shares at a specified price are known as convertible securities. For bonds that mature, either the face value or the stock's actual value can be exchanged. By either the investor or the corporation that issued convertibles, a convertible can be converted.

Convertible bonds are unsecured debt securities that can be converted into stock in the company at the discretion of the bondholder. You can convert your bond into shares by reading its trust indenture, which states how many shares you can get. If the conversion ratio is 40, or 40 to 1, 40 shares of the company's stock can be purchased for one $1,000 bond.

It is possible to refer to the trust indenture's "conversion price" as a "conversion feature," which is the face value of the bond divided by the conversion ratio. The par value of $1,000 divided by the per-share price of $25 results in a conversion ratio of 40.

Converting Convertibles:

When the price of an issued bond exceeds its "conversion price," it is referred to as a "conversion premium." Comparison of current market value to an elevated conversion premium or straight-bond price gives rise to "conversion premium." In the absence of a conversion premium, its straight-bond value is the same as it would have been without it. A stock's current market price is multiplied by a conversion ratio to determine its value.

An issuer's convertible bond would be worth $1,000 at today's $20 share price, equating to 50 shares of common stock. The difference between the conversion value and the premium paid by the bondholder is the conversion premium. You can figure out how much of a premium you'll receive by purchasing the bond for $1,200.

Conversion Premia and Payback:

An investor can calculate the payback time by multiplying the bond's maturity date by its payback term. This will show how long it will take to get their money back (including the conversion premium and any stock dividends). If you acquire as many shares as provided in the conversion premium ratio, the conversion premium plus dividends over the time required to obtain a similar return on a convertible equals the conversion premium plus dividends. The cash flow payback period formula is as follows:

Cash-Flow Payback Period is equal to the = [Conversion Premium / (1 + Conversion Premium)] / [Current Yield - Dividend Yield / (1 + Conversion Premium)]