How to calculate your debt-to-income ratio

Susan Kelly

Oct 02, 2023

The amount of money someone owes is more likely to be on their mind than the amount they can pay back. This could put you in a never-ending cycle of debt, where you must keep getting more loans to pay off the ones you already have. This can put you in a situation where you can't get out of the debt cycle unless you take on more debt. If you want to stop being bad with money and get your finances in order, then first things you should do is figure out how much debt you have compared to yor money. This calculation considers both the total income and the total debt amount. If you know everything about your finances, you can make intelligent decisions about how much debt to take on and how quickly you can pay it off. This section will show you how to figure out your debt-to-income ratio and suggest improving your finances. How about we get started right away?

What are your total annual expenses?

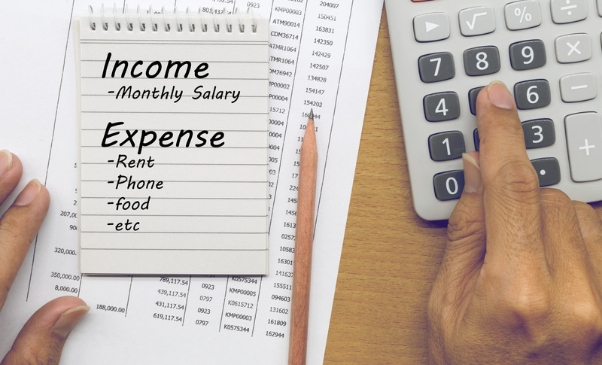

This category includes all of your monthly bills that take up a big chunk of your money, like your mortgage and car payments, as well as your rent, food, and other necessities. After you've added up all your monthly expenses, divide the total by how much money you made during that time. The information given makes it possible to figure out the debt-to-income ratio.

If the ratio is high, you must cut costs or bring in more money. If your balance is high, you might want to consider how to spend less. If a person has much debt compared to how much money they make, this can be an early sign that they are living beyond their means and not using sound money management skills.How much do your total monthly expenses amount to?The ratio of your yearly income to your debts is a major factor in determining your eligibility for a loan. By doing so, you will have a clearer picture of your financial standing. As there are numerous factors to think about, you should make sure you have all the information you need before attempting to calculate your debt-to-income ratio.

The first thing you should do is add up all of your monthly expenses that keep coming up. This category includes your monthly rent or mortgage payment, the payments you make on your car and any other monthly bills you must pay. After that, divide the total by how long it's been since you started getting paid. The information given makes it possible to figure out the debt-to-income ratio.You should consider getting a loan if it's more than half before moving forward. Even if your percentage is less than 25%, you should still consider applying for a loan. However, you should know that you will have to pay it back.What is your total weekly expenses amount to?To determine how much debt a person has compared to how much money they make each week, divide their total weekly costs by their total weekly income. The result is the person's ratio of debt to pay. You now have a percentage directly from what you just did. If you make $1,200 weekly but only spend $600 on all your bills, your debt-to-income ratio is 20%.What is your total monthly debt-to-income ratio?The first number you should look at is the difference between how much you earn each month and how much you owe. All debts, including mortgages and car loans, must be paid off in full, along with all interest and fees. Second, pay close attention to your steady income. Your usual income sources, like pay, bonuses, pension, and so on, will be considered.

After filling out this form, the next step is determining how much of your monthly income goes towards paying off debt. This is the amount of money you save each month to pay your bills and any other costs that may come up. Suppose your monthly payments take up more than 40% of your income. In that case, You might want to talk to a financial expert, get a lower interest rate on your loans, or combine all your debts into a monthly payment you can afford.How much does your total weekly debt-to-income ratio amount to?There are different ways to determine how much debt you have. First, divide the number of your monthly loan payments by how much you make every month. One of these ways is to figure out how much of your weekly money goes towards paying off your debt each month.

After getting the number, the next step is ensuring it falls within an acceptable range. If you want to get back in charge of your money, you need to spend less of your income on paying off your debt. A low score shows that money was not handled well, making it more likely that a loan will not be paid back.How much does your total daily debt-to-income ratio amount to?Do you want to know how much personal debt you carry right now? An excellent way to figure this out is to look at the debt-to-income ratio. You can figure it out by dividing your annual income by the total money you spend daily. Consider every bill that is still due to get the most accurate answer. Your student loans don't count, but your mortgage, car payment, and other loans do. Include your base wage and any tips or extra money you get from freelancing or investments. The following items should be mentioned in some way in your report.

By tracking how much of your daily income goes towards paying off debt, you can figure out how much you are using debt to help you in the future. When you figure out how much power you have, you will see that this is the case. The ratio might help you decide if you can keep living the way you do now or if you need to make some changes.

How much does your monthly debt-to-income ratio amount if you have a fixed-rate mortgage?You must figure out your debt-to-income ratio if you have a fixed-rate mortgage. This method can help you come up with a rough estimate of how much of your monthly income goes towards paying off your debt. You now have a percentage directly from what you just did. Suppose you have more than 45 per cent of your income going towards debt. In that case, you should look into getting a mortgage with a variable interest rate.Conclusion:We hope that our article about how to figure out your debt-to-income ratio was not only helpful but also entertaining. Consider this number if you want to buy a house, get a loan, or even get a handle on your money. If you follow the steps in this article, it will be easy to determine your debt-to-income ratio. You can then use the results of that calculation to help you make financial decisions in the future. Thank you for paying attention and taking the time to read this.