A Quick Guide to Know: How to Forecast Earnings Based on the P/E Ratio?

Triston Martin

Nov 22, 2023

Introduction

When trying to determine the worth of stocks, investors and analysts rely extensively on a metric known as the price-to-earnings ratio (P/E). A P/E ratio can also be used to compare the stock price of one firm to that of its competitors in the same industry or to the cost of an index that represents the entire market, such as the S&P 500. When comparing the price of a stock to its earnings per share, the price-to-earnings ratio (P/E ratio) is a valuable statistic to utilize. If the price of a stock share is high compared to the number of profits it generates, we can conclude that the stock is overvalued. On the other side, if the P/E ratio is low, this could indicate that the stock price is now undervalued in the company's earnings.

Calculating the P/E Ratio

A stock's price-to-earnings ratio may be calculated by dividing the firm's current share price by the stock's earnings per share. This figure can be used to indicate the company's overall financial health. This suggests that if a company provides all of its earnings to its shareholders, each shareholder will get a share of its net income proportional to the number of shares they own. The earnings per share (EPS) is a typical metric that investors and traders use to assess the health of a firm.

What Are the Three Types of Calculations?

The following are the three computations that are used the most frequently.

Last Year's Earnings

This is determined by dividing the stock's current price by the company's earnings in the fiscal year before the most recent one. Please consider a company now trading at the cost of $50 per share for its stock. The earnings of $5 per share indicated for the firm suggest it is likely profitable. It would have a price-to-earnings ratio of 10:1, equivalent to $50 divided by $5. To put it another way, investors are prepared to pay $10 for every $1 in reported earnings at the current price. The problem with this calculation is that the following year could be significantly different from the one that just passed. A company's profits may come in much higher or lower than predicted.

Earnings Forecast

This approach uses the stock's most recent price or the diversified basket of equities. After that, the whole amount is distributed according to an average of the profit estimates produced by analysts and by the firms themselves. Where exactly is the mistake in my calculations? In business, it is not uncommon for actual earnings to fall short of predictions made regarding those earnings. Forecasting the stock market and stock prices is notoriously difficult due to this element of surprise. There is a sense of unknowing over the coming year. The projections will be provided by either financial gurus or asset management firms. Some people will have the proper understanding, while others will have the wrong one.

On most websites devoted to stock analysis, you'll be able to locate ratios based on historical and projected earnings. As a result, you will have something to use as a yardstick when comparing various businesses in the same industry. It's possible for organizations that appear to be pretty similar to one another to have significantly different price-to-earnings ratios. Under these circumstances, more investigation into the cause of the problem is necessary.

Ten-Year Average

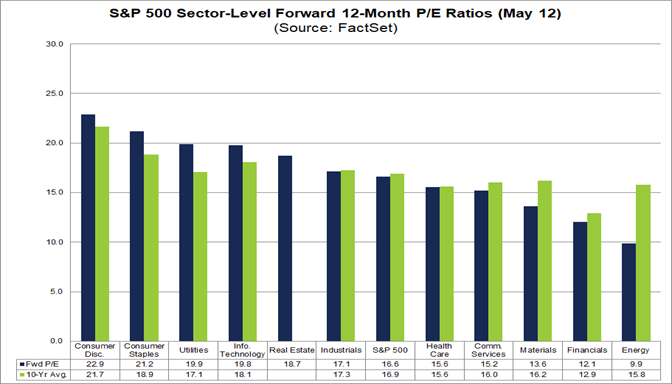

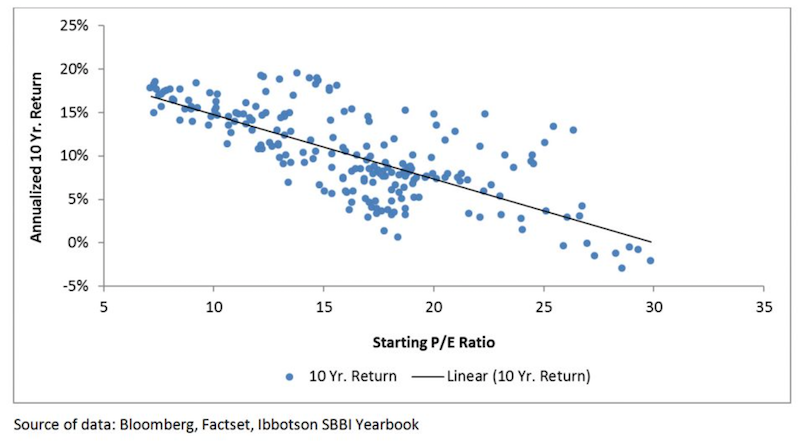

This approach to valuing is often applied to the market as a whole rather than a particular stock. When determining a company's intrinsic value, the current market value is divided by the 10-year average of earnings per share. This specific indicator for valuation is referred known as the P/E 10 ratio. Its purpose is to remedy the disparities that develop depending on wage data from only one year at a time. Studies have demonstrated that the price-to-earnings ratio (P/E 10) is reliable for determining market value. It is possible to use it to determine where you are located both in time and space. This information is frequently utilized in the process of inferring the "price" of the market.

Pros of High PER

"Growth" stocks have a high Price-to-Profits ratio; this indicates that investors have a high expectation of future earnings growth and are prepared to pay a higher share price in exchange. Companies with a high Price-to-Earnings ratio are regarded to be high-growth companies. Investors may give a company a higher PER if they believe there will be lower levels of risk and volatility in the company's earnings due to factors such as a more stable business model or industry or if the company has less gearing. Other factors that may play a role in this prediction include the company's debt level.

Conclusion

Investors need to keep these qualifications in mind when utilizing the price-to-earnings ratio to arrive at an accurate valuation of a firm. The price-to-earnings ratio is commonly used to determine the value of a stock, but the price-to-earnings growth ratio (PEG ratio) is considered a more accurate measure of a stock's value. The PEG is a statistic that looks into the future and can be used to make projections about the potential of a stock.

The issue is that no "magic ratio" can provide investors with all the information they require for a particular store. When analyzing the financial health of a firm as well as the value of its stock, multiple ratios should be considered. Even though every investor needs to be informed about the future, it's possible that providing earnings guidance is not the most accurate way to predict how successful a company will be in the years to come.