A Brief Overview: What Is Annualized Total Return?

Triston Martin

Feb 17, 2024

Introduction

As an investor, you must be as wise as possible with your capital. One way to do this is to figure out the compounded yearly rate of return. The total return, when annualized, tells you how much money you made or lost on an investment each year. The % form is widely used. Annualized total returns can be found for asset classes, including equities, bonds, mutual funds, real estate, and more. By employing this technique, you can compare and contrast two distinct investment options: stock trading and real estate investing. You can still reach your goals even if you hold on to these resources for a long time.

What Is an Annualized Return?

Annualized return, often called annual or annualized total return, is a measure of an investment's performance that considers the compounding effect of interest and dividends over a year. The rate of return is determined purely by the amount of principal invested; any liquid funds or funds previously committed are disregarded. In addition, the annualized return might show an investor what they would get if the yearly return were compounded over a given time frame. Another plus of relying on annualized returns is this. Remember that this calculation does not alert the investor to the possibility of price fluctuations, undesirable changes, or erratic behavior.

To get a more reliable picture of an investment's actual value, many analysts recommend looking at its annualized return over a few years rather than its return rate in a single year. The rate of return on investment over an extended period can be annualized by adding the rates of return over each year or grouping the years. Using the information gleaned from the annualized return computation, an investor can evaluate the performance of their investment by comparing it to the implementation of similar assets.

How Annualized Total Return Works

Imagine you want to compare the performance of two mutual funds. You'll need to know the return for a given period and how long you kept the investment to pull this off.

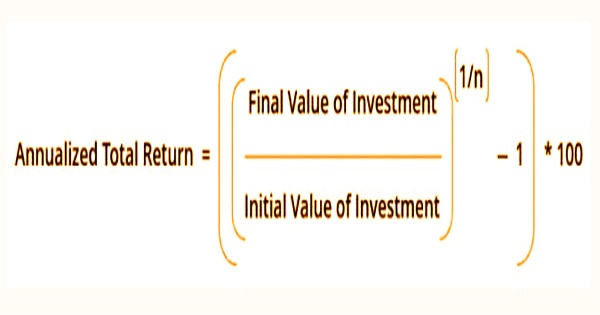

Annualized Total Return Equation

The return, denoted by "R," is the independent variable in the previously presented equation. In contrast, the holding period, marked by "N," is the years over which the investment was held. Assume you have put money into a mutual fund that has returned 7%, 10%, 8%, and 12% annually over the past four years. After all the variables were plugged in, the equation would look like this:

- Computed Total Return Per Annum = 1.07 * 1.10 * 1.08 * 1.03 (one plus.12)

- One minus 1 or 1.09232 minus 1 equals.

- Simply put, 9.23% is 09232 times 100 (to show as a percentage).

- As a result, the mutual fund achieved a total return of 9.23% annually.

Let's pretend you wanted to compare the performance of this mutual fund to that of another, but the two funds' annual returns differ by 1% throughout the two years. Afterward, you would repeat Step 1 with the updated percentages in place of R and the reduced number of N (2 instead of 4) in Step 2.

Annualized Total Return vs. Average Annual Return

More commonly than the annualized total return, the annualized average return is considered when analyzing an investment. Keep in mind that these are not interchangeable units of measurement. The average annual return is calculated by dividing the total return by the years considered in the analysis. Total return calculated on an annualized basis accounts for compounding, which this method does not. Mutual fund performance is often assessed by contrasting the fund's annualized return with similar funds. A fund's average annual return during the prior three years would be if it had a return of 12% in the first year, a loss of 20% in the second year, and a gain of 15% in the third year. The typical rate of return is determined as follows:

- (12%)((-20%)(15)). The result of dividing a number by three years gives 2.33 percent.

The annualized total return over the same period would seem significantly different. When those identical figures are entered into the formula for computing annualized total return, we get the following result:

- Each value represents an annualized total return of (1.12), 0.80, and 1.15, respectively.

- 1/3 – 1 = 0.0100 x 100 ≈ 1.00%

The 20% loss in value from the previous year leaves you with 80% of the original investment balance. For this reason, we use a factor of 0.80. The annualized total return shows the impact of the loss in the second year relative to the average annual return. The 20% drop in year two dampens the favorable effect of the investment when expressed as an annualized total return, which factors in compounding.

Conclusion

An investment's annual return is the profit rate made over a year, expressed as a percentage of the initial investment. One speaks of a gain on an investment when the rate of return exceeds the initial outlay. A higher rate of return might be expected with a greater risk. In many cases, annualized total returns are more information about an investment's value than average returns. It estimates future returns on investments without disclosing fluctuations in value. When analyzing performance, investors place more weight on net earnings or the amount of money investment has gained or lost after deducting fees.