Find Out: How To Fill Out a Budget Planner Sheet?

Susan Kelly

Oct 12, 2023

Introduction

A monthly budget is just a breakdown of all of your income and all of your monthly expenditures. The first step in taking back control of your financial situation and getting back on track is creating and sticking to a spending plan. Making and sticking to a budget will help you keep tabs on your spending and ensure you've covered all your bases. You can discover new ways to save cash and reduce expenses. We suggest keeping all the numbers in your budget calendar every month, as this is when you will most likely make payments on your home costs and debts.

Make a Budget Planner Sheet

You'll need the following things to get started making your budget planner:

- Spreadsheet software on a computer, like Microsoft Excel or Google Sheets.

- A detailed accounting of your regular monthly outlays.

- A detailed accounting of all the monthly expenditures you must cover.

- Maintaining tabs on every dime you bring in every month, whether from a steady paycheck, a side gig, child support, or any other source, is essential.

- After gathering this information, you may start making your budget spreadsheet.

Make a Blank Worksheet to Edit

Creating a new spreadsheet file is the first step in setting up your budget planner sheet. To do this, create a new worksheet in your preferred spreadsheet application. Name your financial advisor something fitting. The monthly Budget is as simple as it gets in this case.

Decide Your Budget Planner Organization

Find out what form of business entity is most conducive to your preferred method of handling money. For instance, a spreadsheet allows you to keep track of your monthly expenses in one convenient location, or you may divide the page into separate tabs for each month if you prefer a more granular breakdown. We'll assume for the moment that your goal is to keep track of your total annual budget on a single sheet of paper. Please move on to Column B and enter "January" there. After then, move horizontally across the sheet, typing "February" in column C and so on until each of the 12 columns contain all the months.

Track Your Income Sources

Suppose you are returning to the first column of the spreadsheet; type "Income" on the second line. Make a new table and label each row under "Revenue" to track the various sources of monthly cash flow. If you're adding up all your money at the end, enter "Income Total" on the line below. Input your earnings into the spreadsheet cells; a simple formula you create will total them for you. To do this, choose the "Income Total" column and then click the empty cell to the right of the column heading. Then, from the main menu at the top of the screen, choose "Autosum or Sum." Next, use your mouse to select the blank spaces in column B (to the right of each new revenue source), and then press the enter key. After you enter your earnings into the appropriate cells, the spreadsheet's built-in autosum mechanism will tally them. Keep doing this, sliding rightward within the same row by one each month.

Enter Your Expenses

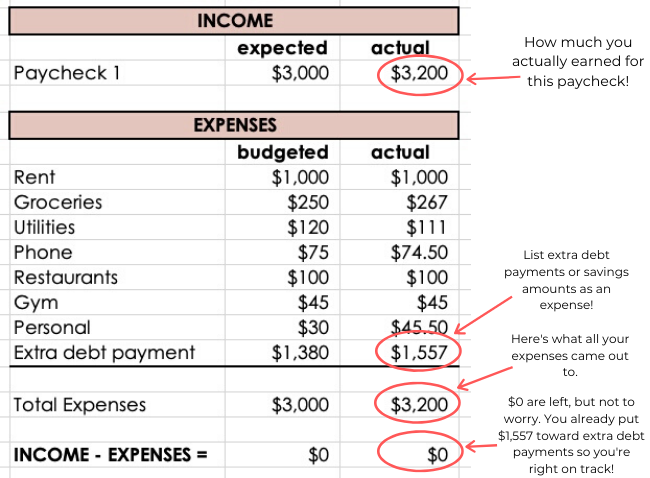

Fill in the column with "Anticipated Costs." A space about two rows down from the one you use for "Income Total." Put a label next to it for each category of costs you plan to include in the sum. Examine your bank statement, credit card statement, or any other record of your transactions from the past month to get a complete picture of what a typical month of spending looks like. The final item on the list in column A should be "Total Expenses" once you've recorded each type of expenditure. Next, as you did with your income, create an Autosum formula for your expenses and then use it over all 12 months of your spreadsheet. When you input the data from the previous month's expenses, you'll see the breakdown of your spending by category and the overall sum.

Compare Your Income and Expenses

The budget planner sheet you've been constructing is nearly complete. One final action is required. Two cells below, where it currently says "Total Expenses," add a new label. You might refer to the sum of your monthly income minus your monthly expenditures as your "Gap." To get rid of this tag, use the blank cell to its right. After selecting the initial number used in the calculation, you'll want to click the Autosum option. If you're going to add this amount to the one in the "Income Total" box, click here. Then, move your cursor to the keyboard's dash (-) sign and press it. Now, while still holding down the control key, click the number that shows in the cell labeled "Total Expenses," and then let go of the keys. Stop mashing the keys and hit the enter key to mechanically have your outgoings subtracted from your takings.

Conclusion

Making a budget using a spreadsheet can be a little unfamiliar if you're used to doing things in a different method. It may be helpful to keep track of small purchases on a separate budget sheet before consolidating them into more significant budget categories. As a result, you'll be able to dig deeper into your spending habits and zero in on the areas where you're losing the most cash. Suppose you need to add new categories of income and expenses or remove ones that no longer relate to your spending patterns. In that case, it is essential to remember to update your income and expense categories. Making a summary of the past 12 months at the end of the year will give you a benchmark from which to build your budget for the future year.