An Overview to the Impact of Dropping out on College Financial Aid

Triston Martin

Jan 01, 2024

Introduction

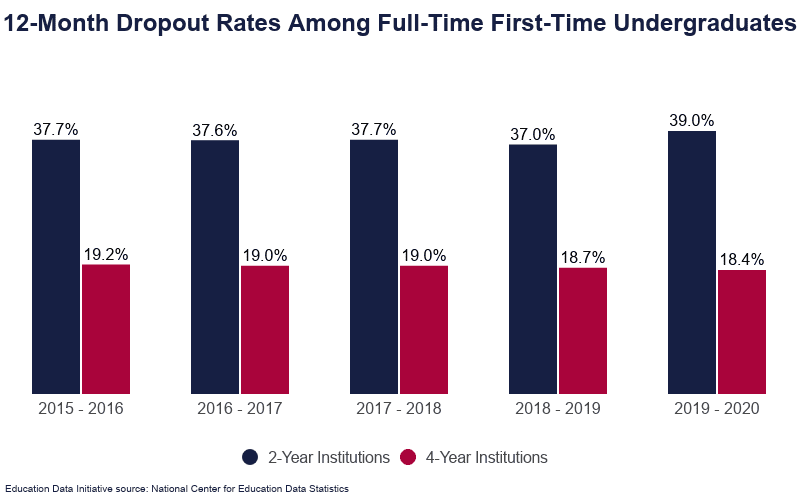

The choice to enroll in college and the option to withdraw are difficult. The overall dropout rate for first-year college students is 40%, notwithstanding their best efforts. There are repercussions of dropping out beyond the apparent emotional and professional setbacks. Present and prospective U.S. undergraduates can apply for federal financial help by filling out a Free Application for Federal Student Aid (FAFSA). Students receive financial assistance all at once, expecting to complete the school year. Know the various requirements for returning financial aid if you are considering dropping out or are forced to drop out of school.

Make Sure You Are Ready for College

Before applying to colleges or taking on student loans, you must be ready for higher education's academic and emotional challenges. Any student contemplating dropping out should explore other options, such as getting tutoring, cutting back on course load, changing academic concentration, or transferring to a different university. In some cases, finishing the current semester can provide you more freedom in terms of taking time off from school or reducing the financial help you will need to repay. To the same extent that enrolling in college can impact your economic outlook, so can dropping out.

You Must Pay Back a Portion

Some federal student aid programs, such as the Pell Grant and the Stafford Loan, require students to repay a portion of their award if they withdraw from college before completing their degree. If the Department of Education concludes that 50 percent or more of the awarded financial help was not used to pay for educational expenses, then the recipient must repay that aid. It's possible that any state-provided funding will need payback to the originating agency.

How Dropping Out Affects Your Financial Aid

Dropping out of school can significantly affect your financial aid, but it may be required in some instances due to issues with your studies, personal life, or family. In this article, we will examine the implications of this change for the various forms of financial assistance.

Student Loans

If your employment status drops below "part-time," you will be required to begin making payments on your student loans. You reach this milestone when you leave school, either voluntarily or involuntarily. The typical grace period for federal and private student loans is six months. You'll be charged a fee if you don't start making payments after the initial six months. Interest will continue accumulating on any private student loans or federal unsubsidized loans you may have during this time. Borrowers with federally subsidized loans will not be charged interest.

If you cannot keep up with your student loan payments after dropping out of school, you may still qualify for deferral or forbearance. Income-driven repayment (IDR) programs allow borrowers to make monthly payments based on their income. Dropouts with federal student debts can participate in loan forgiveness programs. There is a cap on the total amount borrowed from federal student loans. If you have previously taken out federal student loans and then decide to go back to school after dropping out, it's possible that you won't be able to borrow as much money as you had anticipated.

Pell Grant

You may be required to refund a portion of your Pell Grant if you withdraw from school while receiving funding. The university's financial aid office is the place to find out how much you'll have to pay back. You can return to the college in full or negotiate with them to develop an installment payment plan. If the money isn't paid back, collectors may turn the debt over. You may be ineligible for future federal financial aid until the award is repaid.

Scholarships

Successful completion of the academic year or attaining a degree is a common requirement for many scholarship awards. Repayment of the funds may be necessary if you withdraw from school before the deadline. Mark Kantrowitz, an authority on student aid, recommends reaching out to scholarship sponsors before dropping out. When students are experiencing financial hardships, some institutions provide emergency relief. Find out if your school offers this and how to apply for it by contacting the office that handles college financial aid.

Conclusion

A percentage of your tuition may be refunded if you withdraw from college. However, if you do nothing and fail your courses, you may be responsible for the total cost, regardless of how many classes you attended. It is better to drop out of school than to have a failing grade in any of your courses. A lower GPA will be recorded on your official college transcript if you receive a grade of D or F. There may be repercussions for your future academic and career prospects as a result of this. It's essential to formally resign from school even if you think there's no chance you'll ever return.