Everything About the Credit Card Surcharges

Triston Martin

Feb 27, 2024

Introduction

The store may charge an additional surcharge when consumers pay with a credit card. Except when prohibited by local law, taxes can and should be applied. If a company decides to implement tariffs, it must do it transparently. The following guidelines for surcharges are valid solely within the United States. When implementing a tax, merchants must notify Visa or Mastercard. Then, businesses need to make customers aware of the additional cost wherever the transaction occurs (physical or digital). A fee added to the bill must be displayed on the customer's receipt.

What is a Credit Card Surcharge?

Customers are often hit with a "checkout fee" or "credit card surcharge" if they pay with plastic. Because of surcharging, businesses can accept credit cards at no expense to themselves. Interchange fees for using a credit card are instead added to the final total charged to the customer. Not to be confused with the "convenience fee" or "service fee" that credit card customers incur when using a non-standard payment method not offered by the retailer. Unlike convenience fees, which are always prohibited in card-present settings, merchants have the freedom to choose whether or not to impose a premium on credit card transactions regardless of whether the customer is physically present.

How to Calculate Credit Card Surcharges

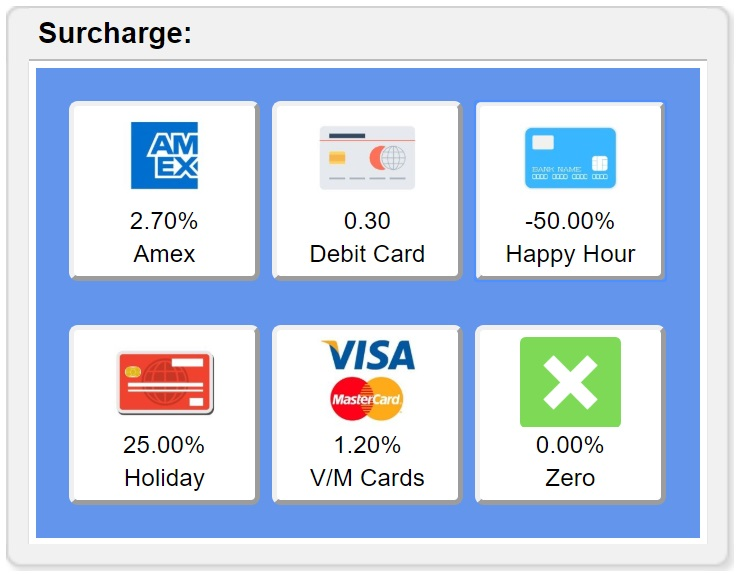

You can only add a surcharge to credit card transactions; prepaid and debit card purchases are exempt from this requirement. Here is a breakdown of how credit card surcharges work, along with details on some of the most popular card issuers.

Notify the Brand of Your Intent to Surcharge

Notifying card issuers is a formality before adding a surcharge, but it is required nonetheless. You can do it on the web with a Mastercard or Visa. Following is an explanation of the fields on the form that request your business's name, contact details, number of locations, channel type, and fee structure.

Choose the Type of Surcharge

Surcharges can be applied to Mastercard and Visa cards at the brand level (for all Visa credit cards) or the product level (for example, World Elite Mastercard). A future modification in your charge structure is possible; however, you must give advance notice to the card brands. Applying the exact surcharge cost, for instance, to all Mastercard credit cards simplifies the calculation. However, as you gain familiarity with the limits, you'll see how the product-level surcharge might help you precisely cover expenditures.

Find the Applicable Surcharge Cap

The surcharge fee can't be higher than what it costs to accept that card brand. You'll have to set the "cap" or the maximum surcharge cost. If you adopt a fee for each brand or each product, the cap will be set differently for each.

Compare Estimated Brand Surcharges

Learning how to compute credit card surcharges should be a breeze if you have all the relevant data at your fingertips. Many major card companies are vocally opposed to the practice of surcharging because they worry that it would cause users to switch to less profitable payment methods. To make matters worse, singling out one brand for a higher price than another may encourage consumers to switch to an alternative brand.

Are Credit Card Surcharges Legal?

In a nutshell, yes, a business can legally add a surcharge. The U.S. Supreme Court upheld the constitutionality of merchant surcharges in a 2017 case. Certain stores may mandate a minimum purchase when paying with a credit card. In a class action case filed in 2013 against card issuers and banks, businesses obtained the ability to impose surcharges or "checkout" fees, but the Supreme Court's order reversed that. There are restrictions on how much and how often merchants can charge these fees. Surcharges can be added to purchases made with credit cards, not debit cards. If you use a debit card, you shouldn't have to pay any extra fees, even if you sign for the transaction (which means it might be handled as a "credit" transaction).

Conclusion

While removing credit card surcharges and reducing merchant processing fees is the ideal scenario, many considerations go into deciding whether or not to implement them. Customers in sectors close to the public sector, for example, may be more accustomed to and understanding of surcharges. However, offering extra fees to your clients in highly competitive markets may be a strategic mistake. Ultimately, it is up to the individual business to determine the best strategy to reduce the fees they must charge customers when making credit card transactions. When making decisions that benefit your business, your customers, and your bottom line, knowledge is power.