A Guide to Learn: How To Make Biweekly Mortgage Payments?

Susan Kelly

Dec 15, 2023

Introduction

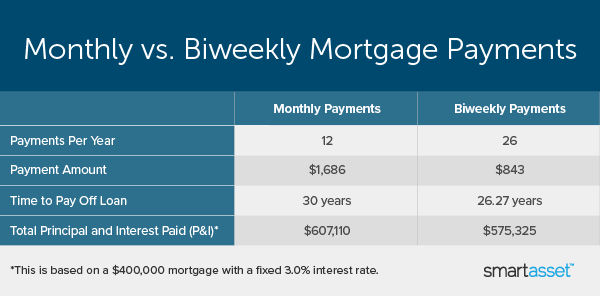

There's a good chance you're also paying a mortgage if you own a house. One monthly payment, for a total of 12 payments per year, is the standard mortgage payment schedule. This benefit is knowing exactly how much you'll pay and when it will be due each month. What would happen if you decided to pay biweekly rather than monthly? Surprisingly, you may be able to save tens of thousands of dollars in interest payments and pay off your mortgage years earlier. How to successfully implement biweekly mortgage payments.

How To Make Biweekly Payments Through Your Lender

Asking your lender to change your payment schedule usually is all it takes to start making biweekly payments instead of monthly ones. However, if you have payments set up to be automatically withdrawn from an account, you must time this correctly. It's best to plan your first biweekly payment for the first month if you decide to switch to biweekly payments in the middle of the month after having already made your monthly mortgage payment. If not, you'll have to pay for both months' worth of payments in a single, potentially stressful installment.

Before converting to biweekly payments, you should verify the crediting method with your lender. To be more precise, you want to know if the principal will be automatically repaid faster if you make monthly payments. You should also confirm that your lender applies for your biweekly payments as soon as they are received. You won't realize the savings of making biweekly payments if your lender doesn't start crediting your loan until the second payment has been made.

Pros and Cons of Biweekly Mortgage Payments

You can reduce your interest costs and pay your mortgage early with biweekly payments. However, your plan may not go as well as you hope if you don't know how to deal with potential problems.

Pros

Pay Less Interest.

The bigger the interest rate and the bigger the loan, the bigger the potential savings. Biweekly payments can save you $35,000 in interest over the life of a $300,000 mortgage at 4 percent and 30 years. Saving $14,280 over the life of a $200,000 mortgage at 3% interest paid fortnightly is possible.

Repay Your Mortgage Faster.

Paying off your mortgage faster can be accomplished by increasing your principal payments. If you follow the two scenarios presented above, your loan may be paid off in around 25.5 and just over 26 years, respectively.

Smooth Out Your Cash Flow.

If your paychecks come every two weeks, you may also find it more convenient to make your mortgage payments every two weeks. If your mortgage payment represents a sizable portion of your monthly costs, this strategy may help you better manage your finances.

Cons

Higher Housing Expenses.

We have less disposable income due to increased mortgage payments. The money could be better put toward retirement savings, paying off debt, or even a family trip.

Increased Borrowing Costs If You Need The Money Later.

If you make a prepayment on your mortgage and then find yourself short on funds, you cannot simply ask your lender to return the money. Only by taking out a new loan, such as a cash-out refinance, a home equity loan, or a home equity line of credit, can you get your hands on cash quickly (HELOC).

Your Lender Might Not Allow It.

If you want to know if your lender will accept partial payments, look at page 4 of the mortgage closing disclosure. Suppose you did not get a closing disclosure or obtained your loan before the widespread adoption of HUD-1 statements. In that case, you should contact your mortgage servicer or visit its website to learn more about its biweekly payment policy.

Conclusion

It would help if you were wary of scammers or specialized software that claims it can automate the process of making biweekly payments. Some businesses may help you change your monthly mortgage payment to twice-monthly installments for an upfront cost. That's the kind of deal you should pass on. Making prepayments on loans shouldn't cost you anything more. Biweekly payments can help you save money if you plan.

If you get paid once a month, it may be habitual for you to pay all of your bills at once rather than dividing them apart. To avoid falling behind on biweekly payments, it's important to save aside enough money each week, if you're paid weekly, to cover the cost of the next payment when it's due. Make sure you sign up for a biweekly mortgage plan, not a bimonthly one. That plan requires two monthly payments, but it doesn't provide the benefit of an extra annual payment.