A Brief Overview: How and When to Rebalance Your Portfolio?

Triston Martin

Jan 25, 2024

Introduction

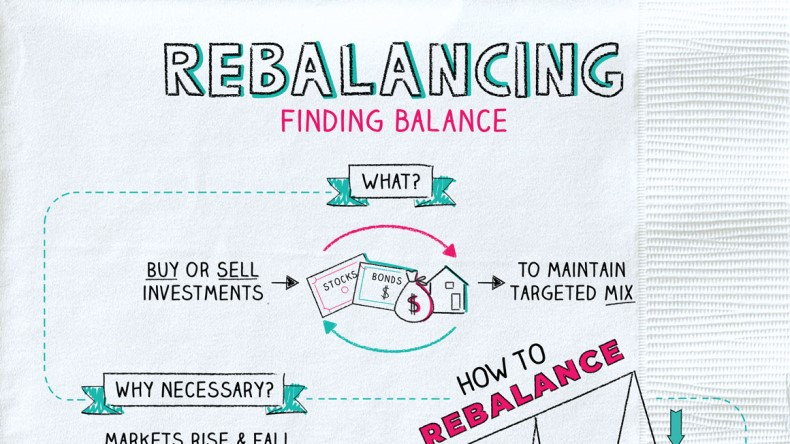

Like receiving an annual physical or an oil change for your automobile, rebalancing your portfolio is essential to maintaining your investments. By selling some stocks and purchasing some bonds, or vice versa, a portfolio can be rebalanced such that its asset allocation more closely tracks the investor's desired return rate and risk tolerance. While rebalancing does include transactions, it is nonetheless consistent with a passive, long-term investment approach, which has historically produced the best results. More information about rebalancing, including its purpose, frequency, and implementation, can be found in the following article.

Why You Need to Rebalance Your Portfolio

Risk mitigation and increased profits are two of the main benefits of rebalancing. An asset allocation strategy balances these two priorities by aiming for maximum profit and minimum risk. Without regular rebalancing, many investment portfolios gradually shift from bonds to stocks. While this has the potential to boost long-term returns, it also introduces substantial risk to the portfolio. For instance, this might increase the highs and decrease the lows of your portfolio. This additional risk may prevent you from reaching your financial goals, depending on your timetable, objectives, and tolerance for the possibility of short-term losses.

As a bonus, when rebalancing two or more asset types with similar long-term predicted returns, you can boost your investment returns while maintaining a safe level of risk. You might improve your returns by rebalancing your holdings between different investments, such as small company funds, emerging markets, and real estate investment trusts (REITs). If that's the case, you may be achieving the holy grail of investing: selling high and purchasing low.

How To Rebalance The Portfolio

To what end does portfolio rebalancing serve? Rebalancing entails selling certain assets and using the profits to purchase other assets to achieve the appropriate asset allocations.

Which Of These Choices Sounds More Attractive To You?

Invest less in successful ventures and more in successful ones. Distribute the additional funds thoughtfully. If, for instance, your portfolio has grown overexposed to a single asset, you can rebalance it by reinvesting your fresh funds in other securities that you find appealing. The "conventional" method of rebalancing, which does not include making any new investments, necessitates selling your best-performing assets, so you may find the second option more appealing. The risk you take.

Not Sure When To Rebalance Your Portfolio?

You should rebalance your portfolio if your asset allocation has drifted more than five percentage points from its target over the past six months. Don't worry about the particulars if this doesn't fit into your timetable. Our findings indicate that no single rebalancing method has reliably outperformed the others. The key is to find a routine that works for you, mark it on your calendar as a reminder, and keep to it.

The Costs Of Rebalancing

While rebalancing your portfolio has many advantages, you should know the fees involved. Rebalancing incurs "transaction costs," which are "actual costs" that "should be considered in the conversation," as Haworth puts it. If your returns have deviated by only 1% or 2% from your target rate, making a trade is usually not worth the trouble.

Rebalancing With A Financial Professional

Rebalancing should only be done if it makes sense for your specific position, and a financial advisor can use their experience and analytical tools to help make that determination. As Haworth puts it, "we might actually discourage rebalancing" if "the market is heading one way, but we don't see fundamentals to warrant a turnaround in portfolio direction." Adding this scrutiny to your decision-making process can provide you peace of mind.

Conclusion

The rebalancing of a portfolio is a crucial aspect of its management. You can maintain a constant level of risk in your portfolio and potentially improve your results through rebalancing. It will help if you use caution when rebalancing so as not to generate too much taxable income in taxable accounts. When you start rebalancing your portfolio, you may find it challenging because everything is brand fresh. However, it is a useful skill and a good practice. Even though it isn't intended to boost your long-term returns directly, it should improve your return on investment as a risk function. Most investors would do well to reduce their exposure to risk by rebalancing their portfolios. Doing so would assist them in avoiding selling off their investments in a frenzy when the market drops. Therefore, the discipline of rebalancing can improve your long-term results.