Learn: What is the Impact of Minimum Payments on Your Credit Score?

Triston Martin

Dec 30, 2023

Introduction

Your credit report and credit score include your most recent payment amount. Your credit card (or loan) payment size does not affect your credit score. Making even the minimum monthly payment on time will enhance your credit score in the long run. While the actual dollar amount of your monthly payments have no bearing on your credit score, the percentage of your available credit does. More than a few points can be subtracted from your credit score if you exceed your credit limit. You can help your credit score recover from the brief drop by paying off your bill as soon as possible.

How Making Minimum Payments Can Affect Your Credit Score?

A consumer's credit score can be considerably impacted by how that consumer utilizes their credit card. Your credit score is directly affected by your payment history and balance on any credit cards you have. On the other hand, creditors can learn a lot about you just by monitoring how you pay your credit card bills. Making your monthly credit card payments on time tells lenders that you are responsible for your debt and will increase your credit score.

Every credit card company records your monthly credit card bill payments to credit reporting agencies. Your credit report will reflect the payment in full or in part. Making all your payments on schedule and in full will not affect your credit rating. However, a credit report showing late payments will alert a lender to a change in your financial condition that puts you in a more precarious position. Your credit rating will drop if you are late with payments or if you use more of your available credit than usual.

How to Avoid the Minimum Payment Trap

It's easy to get into the routine of merely paying the bare minimum, but doing so can have serious consequences for your credit and bank account. Please see below some suggestions that may assist you in increasing your payment amount.

Cut Back Spending in Other Areas

Look at your regular monthly expenses and think of ways you may cut back or eliminate them. Making a budget can help you prioritize paying down debt and make the most of your income.

Earn More Income

If you want to pay off your credit card debt faster, consider working extra hours, taking a second job, or starting a side business.

Limit Your Credit Card Purchases

After you've reduced your credit card debt, make it a practice to charge no more than you can pay that month in full. Then, each month, pay down the entire debt. Saving on interest costs and safeguarding your credit is a win-win.

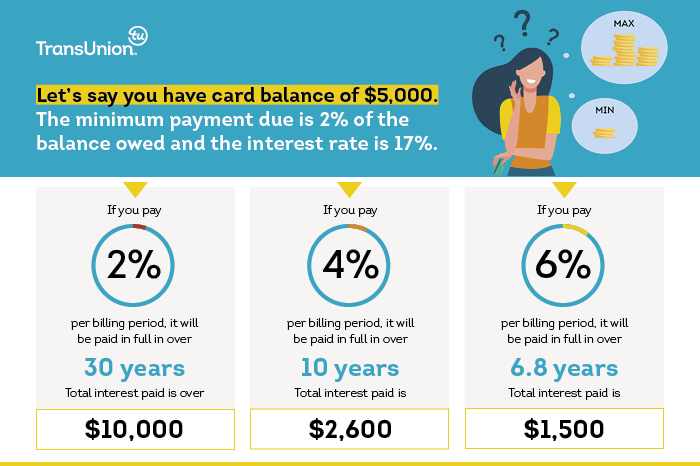

The Benefit of Paying More Than the Minimum

Making only the minimum payment may not negatively affect your credit score, but paying more can help you pay off your debt faster and save money in the long run. Save more and put it toward your balance whenever you can. Some creditors and lenders may look at the date of your most recent payment, which is reflected in your credit report. A borrower who consistently makes only the minimum payment, especially on a large sum, may be considered too high of credit risk and rejected.

Steps to Improve Your Credit Score

- Nobody can do a few things to raise their credit score, but knowing your risk factors is the most important.

- Catch up on any overdue payments.

- Don't go behind on your payments from now on.

Conclusion

Although it is ideal for making a payment equal to or greater than the whole balance due on your billing statement, we understand that there may be instances when this is not possible. In such cases, making only the minimum payment may be acceptable, albeit this strategy is unsustainable in the long run. Pay the entire payment in one lump sum as soon as possible. If you can't pay the entire sum, at least strive to pay more than the minimum.

Making late or partial payments on your statement indicates a deeper problem that may require attention. Take a look at your income and expenses to determine if you can trim the fat. The date your bill is due can be adjusted to coincide with your pay period. As an added perk, some credit cards provide a 0% APR promotional period on purchases and balance transfers for as long as 21 months.