Several Essential Tips for Sticking to Your Debt Payoff Plan

Susan Kelly

Nov 26, 2023

Introduction

A debt payback plan examines what you owe and arranges it into a regular, systematic practice for paying it off. A debt payback strategy reduces the daunting task of paying off debt to more manageable increments. Your debts, as well as your monthly income and expenditures, will be factored into the plan. The ultimate objective of any debt repayment strategy should be to guarantee one's financial future. Debt makes it more difficult to buy the items you want and maintain the standard of living you seek. If you've been allowing debt to keep you from living the life you want, paying it off will free you to make financial decisions based on your values.

Tips For Sticking To Your Debt Payoff Plan

The hardest aspect of paying off debt is developing and keeping to a repayment plan. If you want to improve your chances of succeeding, read on.

Make Sure Your Payoff Plan Is Realistic.

A debt repayment strategy should alleviate some of the stress caused by financial obligations. If you're worried about starting before you even start, it might not be possible. You might want to reevaluate your priorities. If paying off debt based on interest rates has proven too daunting, try tackling the smallest balances first. Finally, it would help if you never had to choose between paying the rent or buying food. Check to see if your monthly spending plan is too ambitious, and make adjustments if necessary.

Track Your Progress

To monitor your monthly development, use a tracking method. Keeping this goal in mind can serve as a source of inspiration and motivation as you work to complete your payoff strategy. This might be an app or a manual approach, like a spreadsheet.

Hold Yourself Accountable

Spread the word that you've created a strategy to tackle your debt, and select a trusted friend or relative with whom you can discuss the details. These should be persons whose financial stability you appreciate or can hold you to your goals. They need to be able to look through your plan and make sure you're still following it. If you're having trouble with any part of the plan, they may even be able to give you some pointers.

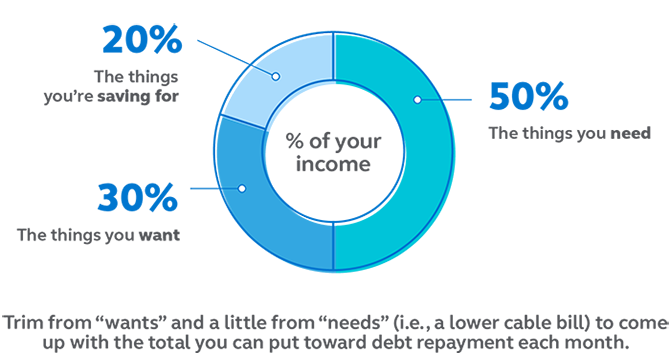

Stick To A Predetermined Budget

Have a monthly budget that includes the money you need for basics, an amount for savings, your debt payments, and the amount you may allocate to everything else while still sticking to your repayment schedule. If you find you can put extra money toward your debt or savings, you may decide to adjust your budget, but you shouldn't modify the money you're spending for everything else. If you have a working budget, sticking to it will increase your chances of success.

Stop Taking On More Debt.

To avoid taking out additional loans, you may need to delay making major purchases while you focus on paying off your debt. Credit cards should be avoided during this time, especially for small purchases. Debt payments can be made more easily, and interest can be avoided altogether by making do with the money you already have.

Remember Why You're Paying Off Your Debt.

If you're having trouble sticking to your debt repayment plan or finding the motivation to do so, remind yourself why you're making this sacrifice. Regardless of how specific your objective is, everyone may benefit from a brighter financial future, greater independence, and reduced stress by eliminating their debt.

Get Inspired By Success Stories.

The most important thing to keep in mind is that you have support. The numbers show how simple it is for anyone to rack up a debt of any size. Since so many individuals are in debt, it stands to reason that just as many have managed to get out from under it. Find inspiration in the experiences of others who have gone before you.

Read Success Stories

There are several success tales online about people who took on and overcame enormous sums of debt. Besides providing motivation, these accounts may also suggest strategies for eliminating financial burdens.

Conclusion

Overwhelming debt might be manageable with a well-thought-out and achievable repayment plan. Learn the ins and outs of each method before deciding which is best for your budget. It would help if you also took the essential precautions to ensure success. The first is creating a workable budget that facilitates better financial management and expedites achieving your objectives. Finally, debt can have negative effects on both your mental and physical well-being in addition to your bank account. For a safe financial future, you should pay off your debt, save for retirement and other goals, and avoid incurring any new debt.