The Uses of International Depository Receipt (IDR)

Susan Kelly

Oct 30, 2023

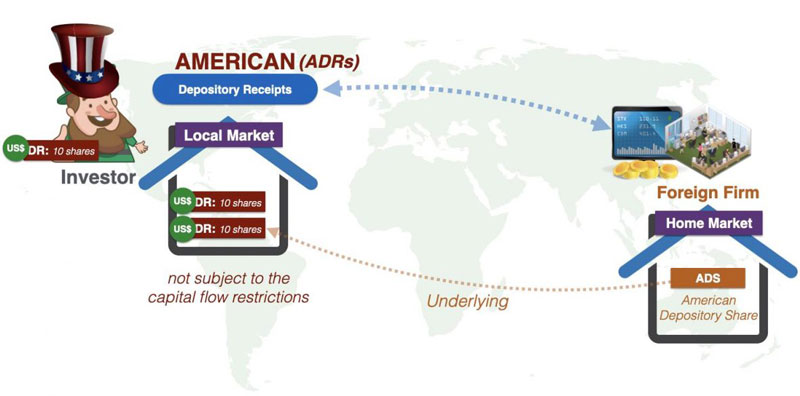

The benefit of using an IDR structure is that it relieves the business of the responsibility of adhering to all of the issuing requirements imposed by the foreign nation in which the stock will be sold. The American Depository Receipt is the equivalent currency in the United States to the IDR (ADR). It represents the owner's rights to a certain number of shares of stock in a foreign firm, which are held in trust by the bank.

American depository receipts are the name most often used in the United States when referring to international depository receipts (ADRs). They are referred to as Global Depository Receipts in Europe, and trading takes place for them on the markets in London, Luxembourg, and Frankfurt.

Acquiring Knowledge of the IDR

As an alternative to the direct purchase of foreign securities on foreign markets, investors may sometimes choose to acquire IDRs instead. IDRs are often used to represent a fractional ownership stake in the underlying company, with each IDR equivalent to one, two, three, or ten shares of the underlying stock. Based on a currency conversion, the price of the IDR will often trade at a level that is quite near to the value of the underlying shares.

Arbitrage chances are taken advantage of when prices sometimes deviate from one another. Arbitrage refers to buying and selling an item simultaneously to make a profit from a disparity in the price that exists across many exchanges and in several different currencies. The trade takes advantage of price disparities between financial products that are identical or nearly similar. Arbitrage is possible because of the inefficiencies that exist in the market.

ADRs' Internal Trading Mechanism

One American depositary receipt (ADR) represents a certain number of shares in an Indian firm; the value of these ADRs is expressed in dollars. Investors from a nation outside of the United States can purchase and sell shares directly, and it is entirely up to the investor whether or not the ADR is converted into an equal number of shares.

By way of illustration, a person in the United States interested in investing in Infosys limited in the United States may acquire ADR from the listed corporation. They will get all of the dividends and capital gains in US dollars as an investor, regardless of the country in which the firm they invested was based.

Variations of ADRs

Every ADR may be placed under one of two major categories:

1. ADRs That Are Sponsored

- A non-American business and a financial institution in the United States have agreed to establish a sponsored ADR.

- In this section, the corporation is responsible for covering any expenditures associated with the issuance of receipts in the American markets.

- In exchange, the American bank is responsible for handling transactions involving depository receipts between the firm and the American investors.

- Just like the holders of regular business shares, holders of these ADRs are granted voting rights.

2. ADRs That Are Not Funded

American banks issue these American depositary receipts (ADRs) without participation from or approval from a non-American corporation.

- As a result, several different banks can issue unsponsored ADRs for the same firm.

- On the other hand, since they do not include the firm's involvement, they are often traded over-the-counter, also known as OTC.

- In addition, they do not provide their stockholders with voting rights.

Several Important Considerations Regarding ADRs

In 2019, the Securities and Exchange Board of India (SEBI), India's governing body for the country's financial markets, released updated regulations for listing depository receipts by businesses. Indian firms are permitted, within the parameters of these standards, to list their depository receipts on a select group of overseas markets. These exchanges include the NASDAQ, the NYSE, and the London Stock Exchange. The trade takes advantage of price disparities between financial products that are identical or nearly similar.

The authorities in charge of regulating the markets in India have never done anything like this before. While Indian corporations could sell debt instruments on foreign markets in the form of masala bonds, the opportunity for Indian companies to sell equity shares was not accessible. The value of an ADR needs to be an exact reflection of the value of the underlying stock. Arbitrage traders take advantage of the minute price differences between exchanges. The National Stock Exchange of India (NSE) was established in 1992, and trading on its platform began the following year, in 1994. Both exchanges use the same trading system and follow the same trading hours and settlement procedure.