What Do we mean by Neural Networks: Forecasting Profits

Susan Kelly

Jan 14, 2024

Forecasting and market research are two areas where neural networks are increasingly being applied. Fraud detection and risk assessment are undisputed leaders in several domains.

Neural networks are widely used in financial operations, business analytics, enterprise planning, trading, and product maintenance, to name just a few of their many potential uses.

If you're a trader who hasn't been introduced to neural networks, we'll walk you through this technical analysis and teach you how to apply it to your trading strategy.

Common Misconceptions about the Neural Networks

Most individuals have never heard of neural networks, and if they aren't traders, they probably don't need to know what they are. Many people who have never heard of it may profit much from neural network technology, think the idea is too high, or consider it a slick marketing gimmick with nothing to offer. This is unexpected.

Some people put all their faith in neural networks, lionizing them as a panacea for all problems after a single success story. However, neural networks are not a magic bullet that can instantly turn you into a millionaire by simply pressing a few buttons.

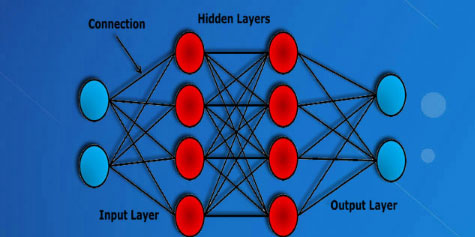

Understanding the function and structure of neural networks is critical to the successful use of neural networks. Narrowing the focus of technical analysis to those traders who want to use their brains rather than their computers is what neural networks are all about; they're the ones who are ready to put in the work to make it work. It's best that neural networks can bring in profits regularly when used appropriately.

Uncover Opportunities using Neural Networks

Misconceptions about neural networks' ability to predict market conditions and deliver actionable advice abound. Neural networks make no predictions. As a result, they use price data to find new opportunities.

In contrast to traditional technical analysis methods, neural networks allow you to make trading decisions based on an in-depth examination of data. Because of their ability to find nonlinear interdependencies that other technical analysis methods cannot discern, neural networks represent an exciting new tool for the professional, thoughtful trader.

Understanding the Best Nets

Neural networks, like any excellent product or technology, have begun to lure those looking for a growing market to themselves. Ads for next-generation software are flooding the market, highlighting the most powerful neural network algorithms ever devised. Even if advertising claims prove to be true in some circumstances, the most you can hope for from a neural network is a 10% gain in efficiency.

The gist is that, while it may perform admirably in some situations, there will always be data sets and task classes for which the previously employed methods are still superior. Remember that it's not the algorithm that's the key to success here. Using neural networks relies heavily on having prepared input data on the desired indicator.

Can we Say Faster Convergence is Better?

People who have misused neural networks feel that the sooner their net produces results, the better. This, on the other hand, is a fantasy. If a network is effective, it cannot be judged solely by how quickly it provides results; instead, users must learn to strike a balance between how quickly their networks train and how well they create results.

How to Correctly use Neural Network

To be a great trader, you'll have to invest a lot of time deciding on and tweaking the governing input items for your neural network. The network will take at least a few weeks to set up, but it can take as long as a few months. The net of a successful trader will also change over time as conditions change. Because each neural network only covers a small portion of the market, neural networks should be employed in a committee.

Use as many neural networks as you need—another advantage of this method is that you can use multiple at once. Each of these many nets might be accountable for a different market component, allowing you to gain a significant advantage on every level. However, it is recommended that you limit the number of nets used to five to ten at a time. There should be a combination of neural networks and conventional techniques. Your trading outcomes will have more clout if you take advantage of this.

Conclusion

Only by giving up on pursuing the perfect neural network can you find true success with neural nets. Ultimately, your success with neural networks depends on your trading strategy, not the network itself. This is why you must clearly understand how neural networks work and utilize them in conjunction with traditional filters and money management rules to find a profitable strategy that works for you.