Bond Rating: What Are They?

Susan Kelly

Oct 24, 2023

In the world of bonds, a bond's creditworthiness is indicated by its bond rating. The rating takes an issuer's ability to pay a bond's principal and interest on time.

Bond-rating firms like Moody's, Standard & Poor's, Fitch, and DBRS are well-known worldwide. Investors can rely on these firms to supply quantitative and qualitative information on the various fixed-income securities on the market.

A speculative bond with a "B-" rating has a higher profit potential than one with a "AAA" rating. Aside from providing an overview of the security's features, how does this metric distinguish between the various bond qualities?

What do we Mean by Bond Rating?

According to a third-party appraisal, a company's bond rating determines the likelihood of repaying a loan's interest and the principal.

When it comes to bond ratings, investors use them to "immediately analyze the credit quality of the bond. They are credit scores for businesses, municipalities, and the federal government.

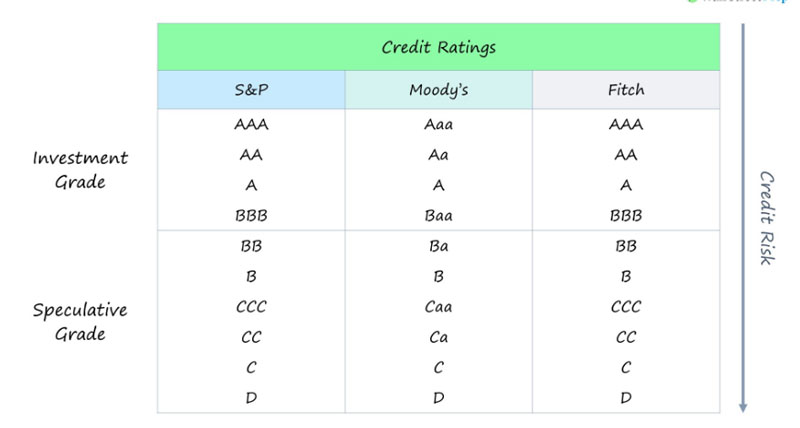

Standard & Poor's, Moody's, and Fitch rating agencies use considerable research and several metrics to assign bond ratings. The creditworthiness of a bond is represented by a letter or a letter and number combination. The methodology used by the various bond rating organizations may cause these ratings to differ slightly.

When it comes to credit ratings, Standard & Poor's and Fitch employ an alphabetical system, with AAA being the highest and D the lowest, respectively, according to Pine. If a decline in credit quality is expected, a "+/-" notation can be appended to indicate that the agency feels that.

Alphanumerical hierarchies used by Moody are slightly different. In general, nevertheless, the bond's safety is called into question once it has a rating higher than a B.

How to Determine a Rating of Bond

Ratings are assigned to financial institutions based on internal and external factors. For example, a bank's overall financial strength rating (a risk measure reflecting the likelihood that the institution would require external monetary support) includes qualities such as this:

A financially strong bank has a rating of A, whereas a poor bank receives an E rating. Rating is based on a review of the company's financial statements and financial statistics.

For example, a parent company or local government agency may be interested in influencing a project's outcome. Research the creditworthiness of these parties as well. An overall external score is computed once all these elements have been considered.

To get an overall grade of BBB, the "intrinsic score" is multiplied by this grade. Using the approach outlined in the preceding guideline, Moody conducts its evaluations. Hybrid securities, for example, necessitate a more in-depth examination of the underlying debt terms.

Several factors go into determining a company's creditworthiness beyond simple ratio analysis and a cursory review of its balance sheet. For each industry, there are a variety of measurements that you can utilize, as well as a variety of external impacts.

Using a top-down projection of overall economic conditions, bottom-up analysis of security characteristics, and statistical distribution estimates of default likelihood and loss severity, investors can obtain a few standard letters that help them quantify their investment.

What are the Factors that Affect the Ratings of a Bond

Even though the exact evaluation procedures of each bond-rating agency are proprietary, there are general links between the ratings and criteria such as yield, the possibility of return on investment, and rules governing the securities and corporate assets.

The higher the bond's rating, the lower its yield typically pays. Yield and Creditworthiness have an inverse relationship: As the possibility of payback falls, corporations must offer increasingly higher interest rates to entice customers to lend them money. If you're willing to put yourself in harm's way, it makes sense to get paid for it.

Additionally, covenants, which govern how a corporation handles its debts, can impact a bond's rating. For example, "the amount of overall debt that a corporation can take on after bond issuance is an example," Pine says. Because it can't take on dangerous debt quantities, it would have a lower default risk in that particular scenario.

Finally, a company's bond rating might be affected by the number of assets. If the bond has insurance or tangible assets to back it up if it is not paid, this might also affect the credit rating of the bond," Pine explains. To put it another way, the better a bond will perform, the more safety nets it has to ensure repayment. Bonds can be categorized into investment-grade bonds and junk bonds based on evaluating these parameters.