What Is a Property Assessed Clean Energy (PACE) Loan?

Susan Kelly

Dec 27, 2023

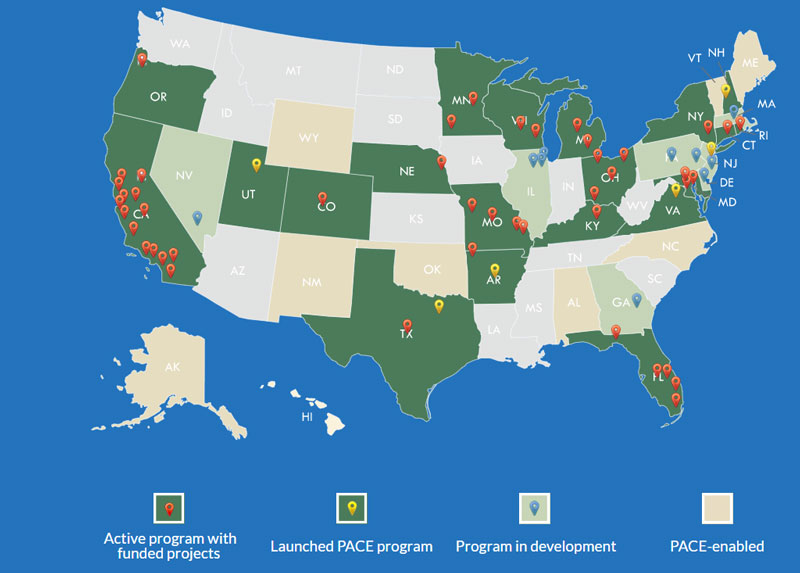

A PACE (Property Assessed Clean Energy) loan is such a kind of financing used to make energy-saving or renewable energy-using improvements to a commercial or residential property. PACE programs are run by the United States Energy Department. More than $2 billion has been spent on projects to make commercial buildings more energy efficient in 36 states and the District of Columbia. As of December 2021, the most recent year for which data is available (2020), more than 306,000 homeowners had taken out loans to make their homes more energy-efficient or fix other problems. So let us know what is a property assessed clean energy (pace) loan and how it works.

How a PACE Loan works

PACE loan financing could be utilized for several energy-efficient upgrades, such as industrial properties, seismic retrofitting for homes or commercial buildings in earthquake-prone areas: installation of solar panels or boilers; energy-efficient roofing; hurricane preparedness measures; and LED lighting upgrades. In this type of financing, the property is used as collateral, and the debt is tied straight to the assets instead of the owner. Some lasting balance on a PACE loan stays the same when the property owner changes.

With PACE financing, you don't have to pay a down payment as a regular mortgage loan. PACE loans don't have fixed monthly payments either. Instead, the owners pay back these loans by adding an assessment to their standard property taxes. These fees are spread out over a certain amount of time, usually between 10 and 20 years, depending on how much money is being used. When people don't pay their assessments on time, they typically get the same fines as when they don't pay their other property tax bills.

Most of the time, PACE financing is not underwritten the same way a regular mortgage is. Improvements to a home's energy efficiency can be paid for in full by the owner, and a person's credit score doesn't matter much in the agreement process. Specific PACE programs are run by state and local government agencies, which have some freedom in setting the rules for approval.

Pros and Cons

Property-based clean energy loans can help property owners improve their cash flow by letting them pay back the loan over a long time instead of all at once. You can't get a loan for things like kitchen appliances that are easy to move, and it might be hard to sell your home if it has a PACE lien.

Pros

- Can improve how money flows

- You don't have to pay a deposit

- It makes properties more environmentally friendly

- Interest payments could be deducted from your taxes

Cons

- There may be expensive setup fees that need to be paid upfront

- Only those who own the property can use it

- When you're trying to sell your home, it can make things harder

- Sometimes, interest rates are higher than usual

How to Apply for a PACE Loan

Like a mortgage or refinance, a PACE loan is based on several factors, such as how much equity you have in your home, how well you've paid your mortgage, and whether or not you can pay back the property assessment. Once approved for a PACE loan, you will need to find a contractor who will work with you. Most of the time, contractors get paid in installments for their work. With a PACE loan, on the other hand, the contractor doesn't get paid until the job is done. You will have to pay back the loan when the project is done, and you pay your property taxes.

It's usually a good idea to look for other loan options besides PACE, just like any other loan. If you decide to get a PACE loan, read the terms and find out if you are eligible for tax credits and have enough money to pay any fees. Most of the time, a PACE loan is paid off in full, but because property assessments are paid once or twice a year, the cost of the loan may be more than a monthly payment.

An illustration of the PACE Loan

In December 2018, a commercial property PACE loan for $25 million was given. This was the biggest C-PACE loan taken out all year. A Nebraska company called Shamrock Development, Inc., which builds homes, got the loan. It will help pay for a project that will make two blocks in downtown Omaha better. With the money, an energy-efficient upgrade was made to an apartment building, a Marriott hotel, and 90,000 square feet of retail space. Parts of the development are done as of 2021, while other parts of the neighborhood are still being built.

Things to consider

People have compared how easy it is to get loans to how lending worked during the subprime crisis in the housing market. In July 2016, the Federal Housing Administration said it would start insuring mortgages with liens connected to the PACE loan program. The payments for PACE loans will be saved with the property taxes. People who use the FHA program to buy a home that already has a PACE loan must pay off any unpaid balance on the loan.