What Is Federal Income Tax? How Does It Work?

Triston Martin

Feb 19, 2024

Internal Revenue Service (IRS) taxes the yearly income of individuals, businesses, trusts, as well as other legal entities in the United States under the federal income tax system (federal tax). What Is Federal Income Tax? Wages, salaries, profits, bonuses, gratuities, investments, and certain unearned income are all subject to federal income taxation as part of a taxpayer's taxable income.

Individual federal income tax rates in the United States are progressive, which means that the tax rate rises in tandem with an individual's taxable income. In the United States, federal income tax rates vary from 10% to 37% and begin at certain income levels. Tax brackets are used to describe the income levels at which different rates apply. Taxes are based on the amount of income that falls inside each tax band.

What Is the Federal Income Tax?

Individuals, corporations, and other legal entities all pay federal income taxes. Federal income taxes apply to all types of income, including salaries, bonuses, monetary gifts from employers, company profits, gratuities, winnings from gaming, and unemployment benefits.

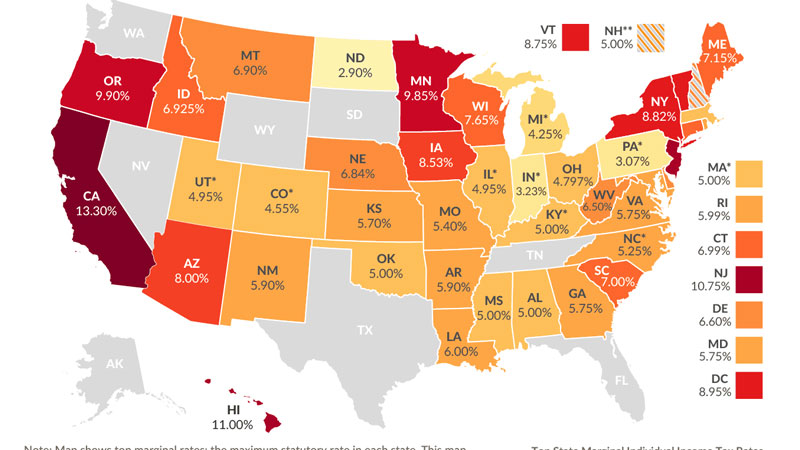

Income tax is the federal government's primary source of revenue. State income taxes are collected in addition to federal taxes in every state save South Dakota, Texas, Florida, Washington, Nevada, Alaska, and Wyoming. Different states have different tax rates.

A History of The Brackets and Rates Used by The Federal Income Tax

The number of tax brackets and rates had varied substantially throughout the last century of the current federal income tax (Before the 16th Amendment was enacted by Congress in 1913, temporary income tax rates existed). By 1920, the number of federal income tax brackets had grown to more than 50. Since then, there have never been less than twenty brackets. Tax Reform Act of 1986 lowered the number of tax brackets from 16 to two, although the number has since risen to the present seven.

Basics of Federal Income Taxation

Only income falling into a given tax bracket is subject to that rate. Therefore, if a taxpayer earns enough to move into a new tax bracket that has a higher tax rate, the taxpayer's whole income is not taxed at that rate; rather, only the income that falls inside the new tax bracket is taxed at that rate. Even a taxpayer in the highest tax band is taxed at a lower rate for part of their income. If a single taxpayer has $60,000 in taxable income, they are in a 22 percent tax bracket, yet they don't pay $13,200 in taxes. They instead pay 10% of $9,875 + 12% of $30,250 and 22% of $19,875 ($60,000 - $40/125) for a $8,990 bill.

Except for the last level, all married tax rates are double those for singles. Some couples in the highest tax bracket may face a "marriage penalty" because they pay more tax when submitting a combined return than they would if they could file as individuals. Because most tax rates for married couples are double those for singles, most married couples receive a "marriage bonus," and they pay less in tax through filing jointly than if each spouse filed separately.

How Federal Income Tax Works

As long as a person or legal entity is a resident of the United States and has earned money in the United States, they are required to pay taxes on that money. Anybody who makes money in the United States is taxed. Either jointly or individually, taxing a married couple is an option.

In order to collect the federal income tax, there are three methods. The first is to have the tax withheld directly from your paycheck by your employer. Quarterly projected payments are another possibility. The third way is to submit yearly reports to the Securities and Exchange Commission. You may need to file a tax return, including the fact that your employer didn't make enough money from your paycheck or that you have additional sources of income, such as rental property or even the sale of stock. The Internal Revenue Service expects to collect close to $3.5 trillion in taxes in 2020. National defense, healthcare, and social assistance are among the many services funded partly by income tax money collected by the federal government.

Conclusion

Taxes might be confusing, but knowing what you owe and how to calculate it can help you avoid paying more than you should. This system is designed to safeguard the less fortunate and guarantee that the wealthy pay minimal taxes. All sorts of deductions may reduce the amount of tax we pay.