Ally Invest Review

Triston Martin

Feb 09, 2024

Ally Invest is a robust brokerage solution that is likely to fulfill the demands of users, but it is an especially suitable alternative for business clients of the digital Ally Bank. Ally Bank customers may access their existing account information through Ally Invest. Trading commissions are reasonable for ally stocks, bonds, and exchange-traded funds (ETFs), and the firm's options costs are among the most competitively priced in the business.

Who Should Opt For Ally Invest?

Ally Invest is an excellent alternative for anyone involved in digital banking with Ally and it is the best option for consumers who already have an account with Ally Bank. With the help of Ally Invest, users can quickly view their whole fiscal situation on one platform.

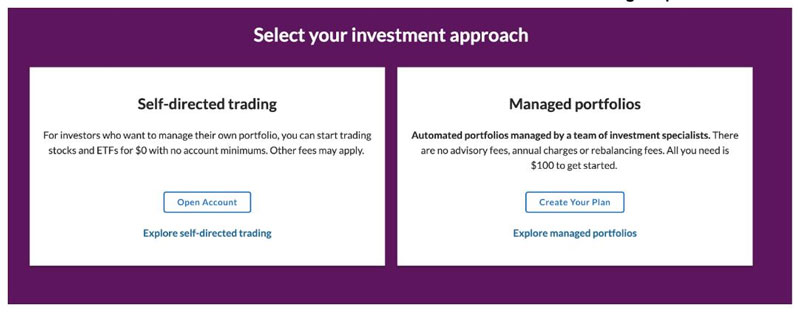

Ally Invest offers a variety of investment alternatives, including self-directed accounts that do not require a minimum balance, and management should ensure accounts with an initial minimum investment of just $100. These options are available to investors with varying degrees of expertise.

About discussing Ally Invest review, it is a wonderful alternative for beginning traders as well as more active traders because it offers reasonable rates, a platform that is solid and easy to use, instructional support, helpful tools like screeners, and exceptional customer care.

Advantages of Ally Invest

- User-Friendly Platform: Even if the major website isn't a streaming platform, it has been well built, is sensitive to user input, and features user-friendly navigation that makes it easy to locate what you're searching for?

While the primary website offers the most functionality in terms of security personnel, trading products, and educational resources, the broadcast version of the website offers a user interface that is intuitive and can be used in conjunction with the primary website. Both versions of the website are available to users at the same time. Ally Invest was straightforward to use, even though it supported several platforms.

- No Restrictions: Ally Bank's royalties, fees, and minimums compare well to those of its competitors. Trading stocks/ETFs or foreign currency does not incur any commissions, and the costs of trading options, at $0.50 per contract, are far cheaper than those of most brokers.

Accounts handled by robots have a $100 minimum deposit requirement, whereas self-directed investment accounts have no such requirement. The yearly cost for Robo-managed accounts is 0.30 percent. Bonds, mutual funds, and low-cost equities (OTC and pink sheet stocks trading for less than $2). Ally Bank’s have set competitive margin rates and fees for their consumers.

- Controlled Accounts: The platforms offered by Ally Invest for self-directed and controlled accounts connect very effectively with other Ally products, such as the company's online banking services, credit cards, certificates of deposit, and home and vehicle lending options.

Thanks to this feature, customers of Ally can view an easy-to-understand picture of their general financial status as well as the many financial products they have in one location. When a user clicks on an investing account, they are sent to the website of the brokerage firm Ally Invest.

- Lesser Interest Rates: The interest rate of 0.50 percent that Ally Bank offers on cash is considered to be quite high, and daily balance transfers between Ally's investment accounts and bank accounts are permitted up to a maximum of $250,000. It is the responsibility of the investor to transfer funds between their investment account and their banking account in order to earn interest on their cash holdings. The investor is also responsible for transferring monies back to their investment account to fund a transaction.

In order for investors to generate risk-free money off of idle wealth, they have to engage in this minimum effort. This is a great choice to consider, given that many online brokers provide rates of interest on cash holdings that are either not very competitive or none at all.

- Specialized Desktop and Mobile Application: Through specialized ally invest app; desktop and mobile banking tools, Ally enables customers to engage in commission-free trading activities in a total of 52 currency pairings.

Disadvantages of Ally Invest

- Difference Across Platforms: There are various differences across the platforms, despite the fact that they each function properly. Options trading, stock and exchange-traded fund trading, and neither fixed income nor mutual fund trading are accessible on any of the platforms.

The principal account website for Ally Invest is designed in an older style, but it offers functionality such as certain screeners and options analysis tools that are not available on streaming or mobile platforms. It is said that this is the case since many traders choose streaming platforms over traditional legacy websites. However, in order to access all of the services, users will need to utilize both types of websites.

- Restriction on Purchase and Sale: You won't be able to buy and sell everything on any trading site. Trading in stocks, ETFs, and options is the sole type of trading that is supported by the mobile app. In a similar vein, screeners and other tools for advanced choices are not included in the mobile app.

- No Support to Some Services: Trailing stops and dependent orders are not supported by Ally Invest. These types of orders would allow users to attach potential revenue and prevent levels to an original limit order. Because of this, the trader will need to place a new order after a purchase requisition has been completed in ortoblish stop-loss and profit-taking levels.

Additionally, the trader must cancel manually when the profit loss or halt is triggered. Because this capability is already included in more recent trading modules, it would be great if Ally's platform could incorporate it as well. Ally Invest lags behind other brokerage firms in this regard, which is disappointing considering that many traders enjoy utilizing trailing stops and dependent entries because they are highly helpful tools.

- No Support to Cryptocurrencies: Trading in futures contracts or cryptocurrencies is not supported on any of the platforms offered by Ally Invest.